CIO Publications

Gain expert perspective on the potential risks and opportunities ahead in the latest reports published by our global Chief Investment Office (CIO).

Latest publications

PERSPECTIVES Outlook

CIO PERSPECTIVES: Economic and asset class update – September 2025

Published following our quarterly CIO Day, this outlook provides a summary update of our economic and asset class views for the year ahead.

Sep 12, 2025

CIO Podcast

PERSPECTIVES Weekly podcast: September 15 – Fed watch: waiting for a rate cut

Markets are anticipating a policy shift this week from the Federal Reserve, which is expected to deliver the first of several rate cuts that could be spread out over the next year, says Dr Dirk Steffen, the Private Bank’s EMEA CIO. “It looks like the US central bank is now pondering the labour market much more,” Dirk says, pointing to weak jobs data to explain why the Fed might look beyond a recent uptick in consumer prices.

Sep 08, 2025

PERSPECTIVES Special

Italy: moving forward

Italy’s economy has convincingly weathered the events of recent years and is now a relatively strong performer in a European context. This new PERSPECTIVES Special report considers the implications for the country’s future development and financial markets.

Aug 04, 2025

PERSPECTIVES Outlook

CIO PERSPECTIVES: Economic and asset class update – June 2025

Published following our quarterly CIO Day, this outlook provides a summary update of our economic and asset class views for the year ahead.

Jun 03, 2025

PERSPECTIVES Special

Alternatives & Strategic Asset Allocation

Alternative investments are an increasingly important asset class and have experienced robust growth over the past two decades. In this report, we look at the advantages and challenges of integrating them into a portfolio.

May 19, 2025

PERSPECTIVES Special

Energy Transition: Utilities and electricity grids

As demand surges, primarily due to electrification and data centre expansion, the need for low-emission energy sources becomes critical. This transition necessitates significant investments in grid expansion and modernisation to integrate renewable energy sources while maintaining system stability and resilience.

May 16, 2025

PERSPECTIVES Special

China announces stimulus measures

China unveiled several stimulus measures on May 7 and it was confirmed that the U.S. and China would hold official tariff negotiations this week. In this PERSPECTIVES Special, we look at the impact of these events on Chinese equities.

May 06, 2025

PERSPECTIVES Special

Strategic Asset Allocation: Robustness amidst uncertainty

Our new special report describes our approach to Strategic Asset Allocation (SAA) – the key driver of multi-asset portfolio returns.

May 05, 2025

PERSPECTIVES Special

Trump’s first 100 days in office

The first 100 days of the President Trump’s second presidency has clearly pointed to an ‘America First’ agenda. We take a closer look at portfolio impact and what this means for investors globally in this PERSPECTIVES Special.

May 01, 2025

PERSPECTIVES Special

Asia: Top investment picks amid tariff uncertainty

In this CIO Special, we look at four possible investment areas and consider their merits.

Apr 29, 2025

PERSPECTIVES Outlook

CIO PERSPECTIVES: Economic and asset class update – April 2025

This is an updated version of our quarterly PERSPECTIVES Economic and asset class outlook following our ad hoc CIO Day.

Apr 25, 2025

PERSPECTIVES Special

Hefty stock price reactions to U.S. tariffs

U.S. trade and tariff policies and their lack of predictability have caused significant price fluctuations in all areas of the financial markets. Browse this page for more details.

Apr 17, 2025

PERSPECTIVES Special

Long Term Capital Market Assumptions 2025-2034

Long term Capital Market Assumptions (LTCMA) form a vital component of systematic long-term asset allocation approaches. This report highlights significant developments to our 10-year (i.e. 2025-2034) asset class return assumptions since the last review, and the impact of macroeconomic and monetary policy developments, amongst other factors. It presents LTCMA for selected sub-asset class indices within equities, fixed income and commodities.

Mar 27, 2025

CIO Insights quarterly report

CIO PERSPECTIVES: Q2 2025 Update

The latest quarterly update of our views includes 2025 and 2026 forecasts for GDP growth and inflation, along with 12-month targets for key policy rates and markets.

Mar 25, 2025

PERSPECTIVES Outlook

CIO PERSPECTIVES: Economic and asset class update – March 2025

The latest quarterly update of our views includes 2025 and 2026 forecasts for GDP growth and inflation, along with 12-month targets for key policy rates and markets.

Mar 25, 2025

PERSPECTIVES Special

EU carbon market: more to come

These changes should accelerate Europe’s path to decarbonization, reinforcing the EU’s leadership in climate policy. Industries will need to adapt to tighter regulations, while investors navigate an evolving carbon market with new risks and opportunities. The coming years could shape the balance between economic growth and environmental responsibility, potentially setting a precedent for future carbon pricing mechanisms worldwide.

Mar 10, 2025

PERSPECTIVES Special

Healthcare and MedTech: A blueprint for growth

In this PERSPECTIVES Special, we investigate the structural drivers of healthcare along with the recent developments and main opportunities in the sector. We also provide a market outlook focused on earnings prospects, valuation, and potential cyclical tailwinds.

Feb 26, 2025

PERSPECTIVES Special

Higher tariffs for longer

In this PERSPECTIVES Special we look at both the prospects for tariffs implementation and their possible impact on U.S. and European equities.

Feb 18, 2025

PERSPECTIVES Special

Where a potential Russia-Ukraine ceasefire might lead

In this PERSPECTIVES Special we will look for how any potential end to Russia’s invasion of Ukraine might impact financial markets.

Feb 14, 2025

Future Fundamentals podcast

Putting nature on the balance sheet

In our Future Fundamentals podcast, Naoko Ishii, Executive Vice President of the University of Tokyo and Director of the Center for Global Commons, and Markus Müller, our Chief Investment Officer for Sustainability, discuss putting nature on the balance sheet and how to build a coordinated financial response to this global challenge.

Feb 11, 2025

PERSPECTIVES Special

UK assets: a bumpy start to 2025

In this PERSPECTIVES Special we examine the reasons behind the UK assets’ bumpy start to the year. Issues covered include the re-pricing of global interest rate expectations, vulnerabilities from the UK’s “twin deficit”, the fiscal outlook, Bank of England policy options and the outlook for sterling, UK bonds and UK equities.

Jan 16, 2025

CIO Annual Outlook

Annual outlook 2025: Deeply invested in growth

In PERSPECTIVES, the Deutsche Bank investment magazine, we review the landscape for the year ahead to identify the broader issues affecting investors over both short- and long-term horizons.

Dec 10, 2024

.webp)

PERSPECTIVES Special

ESG Survey 2024: Investing in the sustainable transition

Our 4th annual ESG Survey shows that investors are already investing in the sustainable transition, with evolving views on what are likely to be the leading future sectors and return drivers. Fueled by pragmatism as well as principles, ESG investment is happening. Read more.

Nov 12, 2024

PERSPECTIVES Special

Decarbonizing portfolios: 10 key factors

Portfolio decarbonization will become an increasingly important topic. Investors need to understand the key issues involved.

Aug 23, 2024

PERSPECTIVES Special

Circular materials use: the need for change

In this CIO Special report we examine what’s driving Earth Overshoot Day and where innovation is offering hope for our planet's future.

Jul 31, 2024

PERSPECTIVES Special

Investing in EU carbon markets: where now?

Carbon markets are likely to play a major role in promoting sustainability and innovation, offering new opportunities for investors and policymakers alike.

Jul 25, 2024

PERSPECTIVES Special

Energy transition: investment perspective

The renewable energy sector is experiencing remarkable growth. However, this rapid expansion faces challenges. In this report, we explain why the renewable energy sector’s trajectory remains positive.

Jul 03, 2024

PERSPECTIVES Special

Bottoming out in the German housing market

It remains a challenging environment for the German housing market, but rate cuts, economic growth and structural rental market shortages should help the market to bottom out.

Apr 30, 2024

Future Fundamentals podcast

Investing in the Blue Economy: a blueprint for action

In our Future Fundamentals podcast, Karen Sack, of ORRAA, and Markus Müller, our Chief Investment Officer for ESG, take a deep dive into the sustainable blue economy.

Apr 26, 2024

PERSPECTIVES Special

China’s economy: awaiting the right cues

China recently released a flurry of Q1 economic data. But while GDP numbers were surprisingly strong, some other activity measures continue to disappoint. So has China’s economy really turned a corner?

Apr 18, 2024

PERSPECTIVES Special

Bitcoin: from bubble to mainstream?

Bitcoin is unlikely to assert itself as a widespread medium of exchange but may be on its way to mainstream acceptance as a store of value, although the risks of holding it remain high.

Apr 11, 2024

PERSPECTIVES Special

Smart Mobility: EVs and batteries present opportunities and risks

Favourable long-term trends for the electric-vehicle market remain intact – but an excess supply of battery metals means the outlook for miners remains clouded.

Mar 19, 2024

PERSPECTIVES Special

LTIT: Sustainable Food Systems – favourable entry points ahead?

Sustainable food systems (SFS) deliver food security and nutrition in ways that are sustainable in economic, social and environmental terms. Transitioning towards sustainable food systems could open up business opportunities worth USD4.5 trillion per year by 2030.

Mar 11, 2024

PERSPECTIVES Special

India: Will a billion voters move markets in the world’s biggest democratic election?

India, the world’s largest democracy, is heading to a national vote, with results expected by the end of May. Almost one billion registered voters will make this the biggest election exercise anywhere, ever.

Mar 07, 2024

PERSPECTIVES Special

Why women’s financial inclusion matters

The empowerment of women in the labour force is important in ways that go beyond the critical matter of social justice. Female financial inclusion and gender equality are “macrocritical” to boosting economic activity.

Mar 07, 2024

PERSPECTIVES Special

Asset allocation for private clients

Strategic asset allocation for private clients starts with detailed knowledge of an investor’s risk profile, investment horizon, and performance targets, among other considerations.

Feb 23, 2024

PERSPECTIVES Special

Long-term investment theme Digitisation: going to the next level

For investors, digitisation provides a wide range of investment alternatives, with business activities such as cloud computing, Internet of Things (IoT), digital entertainment, and others showing substantial growth potential.

Feb 19, 2024

PERSPECTIVES Special

Consumption recovery through 2024 provides opportunities

Consumers are holding up relatively well in the U.S. and Europe, despite a weaker economic environment. This could yield interesting opportunities in the stock market, particularly in the area of discretionary consumption.

Feb 02, 2024

PERSPECTIVES Special

Managing investment uncertainty with asymmetric strategies

Adherence to strong convictions in the face of market-moving events can potentially trigger undesirable timing mistakes. Asymmetric strategies can allow more potential upside for a given portfolio risk.

Jan 19, 2024

CIO Insights quarterly report

Annual Outlook 2024 | Our long-term investment themes (LTIT)

We see these as the key global challenges: how to sustainably utilise and conserve our global resources; how to provide for the global population, and how to develop key technologies to help us all do this.

Dec 26, 2023

PERSPECTIVES Special

ESG Survey 2023: Sustainable transition and investment

Over the last three years, our annual survey has examined our private, business and institutional clients’ attitudes to the multiple dimensions of ESG (environmental, social and governance) investing. This year, we had 1,759 responses to our survey, double the 849 received in 2022.

Nov 22, 2023

PERSPECTIVES Special

ESG & investment performance: think strategically

The key to sustained long-term returns from ESG investment is effective strategic asset allocation.

Oct 24, 2023

PERSPECTIVES Special

Smart mobility: switch, optimise, prioritise

Once we looked to technology to make transportation systems cheaper, faster or safer. But “smart mobility” needs to be more sustainable too - and the primary challenge may be social in nature.

Oct 20, 2023

Future Fundamentals podcast

Sustainable cities

The Private Bank’s ESG CIO Markus Müller and Dr. Philipp Rode of the London School of Economics (LSE) look at how cities can adapt to increasing social, economic and environmental pressures in an ever-more urbanised world.

Oct 17, 2023

PERSPECTIVES Special

What Global South developments mean for Asia

The expansion of the BRICS coalition, with six nations set to join at the start of 2024, will provide the group with increased access to mineral resources and impact global supply chains.

Oct 12, 2023

PERSPECTIVES Special

ESG investment: understanding system changes

Environmental constraints mean that system changes will be necessary to meet four key human demands –for energy, food, manufacturing and mobility.

Oct 11, 2023

PERSPECTIVES Special

Land resources: Conservation and regeneration

Our planet provides an abundance of land-based resources that we use to meet our needs, but just five key demand areas - cement, aluminium, steel, plastics, and food - account for around 37% of global CO2 emissions.

Aug 22, 2023

Future Fundamentals podcast

Measuring sustainability

Deutsche Bank Private Bank’s ESG CIO Markus Müller and Anna Katharina Mayer, Club of Rome member and FindingSustainia co-founder, look at the complex issues around measuring sustainability – in other words, how we assess the real impact of corporate, government and individual actions on the natural world around us.

Aug 21, 2023

CIO Nature Series

Rainforests: the Earth’s green lung

Rainforests provide invaluable ecosystem services supporting climate management, biodiversity, and rural livelihoods—but they are also fragile. In this publication, we focus on four key concerns: deforestation, climate change, poaching and illegal trade, and mining and oil extraction

Aug 02, 2023

Future Fundamentals podcast

Sustainable value chains

Deutsche Bank Private Bank's ESG CIO Markus Müller and Deutsche Bank Research’s Marion Laboure look at value chains in the global economy – and why there are increasing concerns about their sustainability.

Jul 13, 2023

PERSPECTIVES Special

Infrastructure: supporting a sustainable future

This CIO Special on one of our long-term investment themes looks at possible future developments in the infrastructure sector, based on the four key themes of resilience, sustainability, innovation and inclusivity.

Jul 04, 2023

PERSPECTIVES Special

The Ocean: an essential pillar of planetary life

In this publication, we take a close look at the environmental benefits we gain from the marine environment, the definition of a Sustainable Blue Economy, development areas and problems and how we can help finance sustainable maritime nature-based projects.

Jun 08, 2023

PERSPECTIVES Special

Land: A key Life Pillar

In our publication, we take a deep look at the importance of biodiversity, particularly from an investor's perspective.

Apr 18, 2023

PERSPECTIVES Special

Land – A key Life Pillar

In our latest publication, we take a deep look at the importance of biodiversity, particularly from an investor's perspective.

Apr 18, 2023

PERSPECTIVES Special

Energy Transition: the quest for emissions-free energy

Our CIO Special report looks at a central challenge for the world today: how we produce and use energy in a more sustainable way.

Apr 12, 2023

PERSPECTIVES Special

Big Tech: Regulation remains an important factor

In our CIO Special, we look at the regulatory picture in jurisdictions around the world and consider the investment outlook.

Mar 09, 2023

PERSPECTIVES Special

India: Why it will be a USD 7 trillion economy by 2030

In our latest CIO Special – India: Why it will be a USD 7 trillion economy by 2030 – we look at the structural shifts taking place currently in India which are setting the stage for it to become the fourth largest economy in the world by the end of this decade.

Mar 02, 2023

CIO Nature Series

Mangroves: why they need protection

Mangroves are highly important for biodiversity and play a crucial role as nature-based solutions to mitigate the effects of climate change, even though they make up less than 1% of all tropical forests worldwide.

Jan 24, 2023

CIO Nature Series

Mangroves: why they need protection

Mangroves are highly important for biodiversity and play a crucial role as nature-based solutions to mitigate the effects of climate change, even though they make up less than 1% of all tropical forests worldwide.

Jan 24, 2023

PERSPECTIVES Special

Future European infrastructure: investing in change and resilience

Sustainability and security considerations, enhanced policy support and technological development are making European infrastructure an investment focus.

Dec 15, 2022

PERSPECTIVES Special

Peak inflation and beyond

Some measures of inflation may be at, or near, their peak but this is by no means the end of the story. In our new special report, we draw some broad conclusions.

Nov 24, 2022

PERSPECTIVES Special

U.S. and European real estate: taking a closer look

The real estate sector faces a difficult global economic environment as central banks continue to tighten monetary policy. We consider the varying circumstances and outlooks for different sectors and regions.

Nov 10, 2022

PERSPECTIVES Special

ESG Survey 2022: Trends and concerns

In this year's survey we asked almost twice as many questions, with the aim of getting a more complete view of our private, institutional and business clients’ attitudes to ESG.

Nov 08, 2022

Future Fundamentals podcast

Sovereign carbon credits

Claire Coustar of Deutsche Bank’s Investment Bank joins Markus Müller, Chief Investment Officer ESG & Global Head Chief Investment Office at Deutsche Bank's Private Bank, to discuss the recent evolution of the sovereign carbon credits market and how it will help us value and protect natural assets.

Nov 03, 2022

PERSPECTIVES Special

Cities under threat: real estate investment and climate change

Cities both exacerbate climate change and suffer from its consequences – e.g. through flooding, or excess heat, or changing patterns of disease. Getting them to work better must be a key environmental and social priority.

Nov 01, 2022

PERSPECTIVES Special

Commodities, the energy transition and ESG portfolios

Energy price volatility has had an obvious impact on ESG portfolios this year, but we also need to consider the longer-term dynamics around energy and commodity markets.

Oct 19, 2022

PERSPECTIVES Special

Ensuring a sustainable blue economy

The Ocean provides key ecosystem services that are crucial for human wellbeing and the prosperity of the global economy. Learn more on how a sustainable blue economy could be implemented.

Oct 14, 2022

PERSPECTIVES Special

Energy and Asia: future challenges

Our CIO Special looks at the rapidly growing Asian energy market and how policymakers are trying to satisfy growing demand – while also reducing carbon emissions and improving energy security.

Oct 13, 2022

PERSPECTIVES Special

UNFCCC REDD+ and the power of sovereign carbon

Our CIO Special looks at the rapidly growing voluntary sovereign carbon credit market, reinvigorated by agreement on a new framework for asset issuance.

Oct 11, 2022

PERSPECTIVES Special

India: on the cusp of energy transition

In this CIO Special we look at the remarkable progress that India has achieved in its energy transition from fossil-fuel based sources to sustainable and green ones.

Sep 23, 2022

PERSPECTIVES Special

Nature-based Solutions and the climate crisis

Nature-based Solutions (NbS) will help us tackle the climate crisis. But to fully harness their potential, we need a precise conceptual understanding of what they are and the benefits they provide.

Sep 22, 2022

Future Fundamentals podcast

The future of work and the ReRo revolution

Marion Laboure, Senior Economist at Deutsche Bank and Research Lecturer at Harvard University, joins Markus Müller, Chief Investment Officer ESG & Global Head Chief Investment Office at Deutsche Bank's Private Bank, to discuss the continuing process of workplace change and the Remote working and Robotics (ReRo) revolution.

Jul 21, 2022

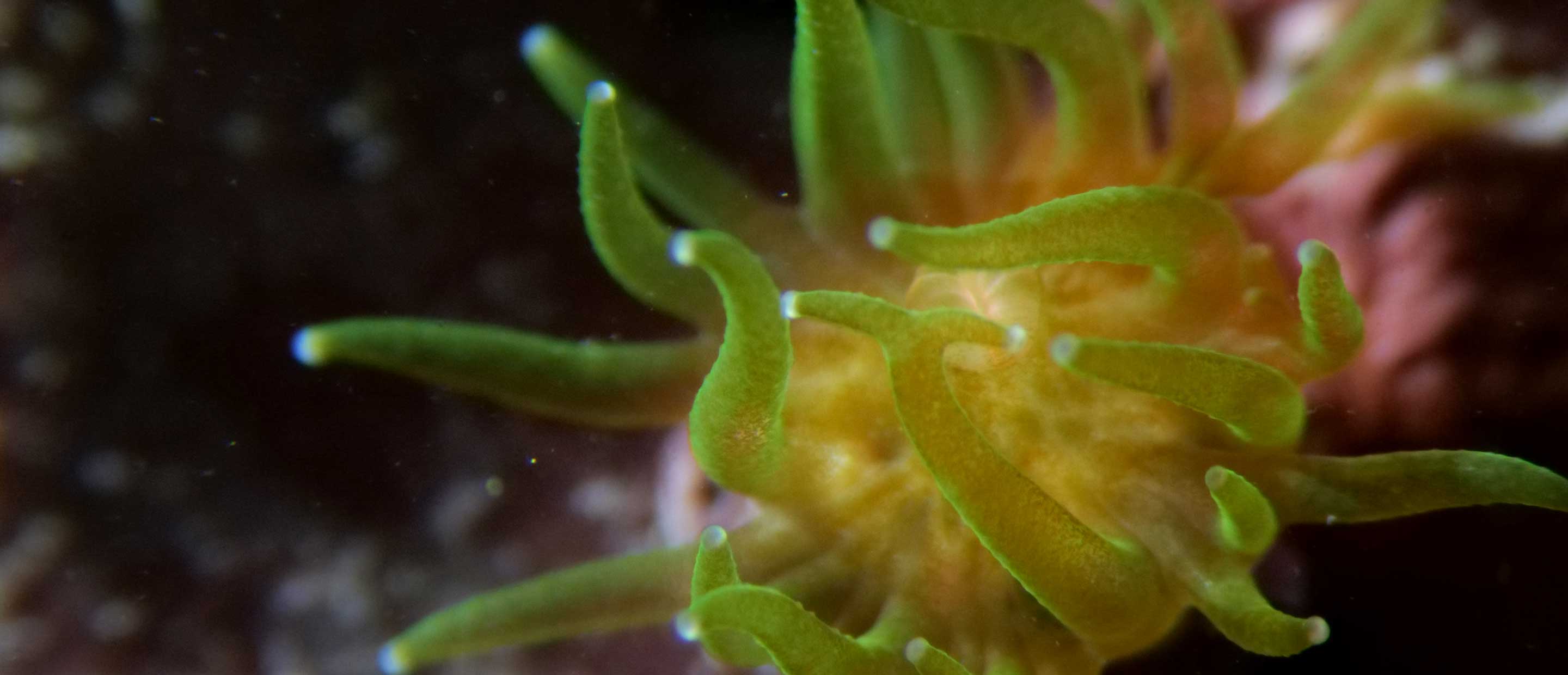

CIO Nature Series

Corals: the rainforests of the sea

This introductory guide to the global threats facing coral reefs – and what we can do to reduce them – is part of our new CIO Nature Series providing insights on nature-based solutions to address climate impacts and foster adaptation efforts.

Jun 24, 2022

PERSPECTIVES Special

Ocean finance: redefining the value chain

As we mark the UN’s World Oceans Day for 2022, we face major challenges in building a sustainable blue economy. This CIO Special, produced in collaboration with the Ocean Risk and Resilience Action Alliance (ORRAA), explains how the global financial sector will play an important role in finding solutions.

Jun 08, 2022

PERSPECTIVES Special

The future of work and the ReRo revolution

Remote working looks likely to persist in some form for many employees as the world learns how to live with coronavirus. But our new CIO Special argues that remote working needs to be seen as just one component of a continuing process of workplace change.

Apr 04, 2022

PERSPECTIVES Special

Biodiversity: the new playing field for ESG assessment

Our CIO Special looks at likely future trends in ESG assessment and why biodiversity will be an increasingly important consideration.

Mar 21, 2022

PERSPECTIVES Special

Cyber security: protection for the digital environment

In our new CIO Special we analyse the developments and trends impinging on cyber security and we focus on the issues and challenges created by increasing online transactions and interactions.

Feb 15, 2022

PERSPECTIVES Special

Venture Capital investing: a closer look

Our CIO Special report and introductory video discuss how the VC sector is developing and its role in portfolios.

Jan 10, 2022

PERSPECTIVES Special

Venture Capital in entrepreneurship

Find out more about the role of Venture Capitalists in our CIO Special report.

Jan 09, 2022

PERSPECTIVES Special

Venture Capital trends

Read about the latest trends in global Venture Capital investment and the wide range of risks associated in our CIO Special venture capital report. Browse today.

Jan 08, 2022

PERSPECTIVES Special

Portfolios and Venture Capital

Find out more about the potential role of Venture Capital investing in portfolios as well as diversification in our CIO Special report.

Jan 08, 2022

PERSPECTIVES Special

What is Venture Capital investing?

Find out more about the history and lifecycle of Venture Capital investing in our CIO Special report.

Jan 07, 2022

PERSPECTIVES Special

Venture Capital investing: conclusion

We attempt to summarise the main positives and negatives of Venture Capital investing in our CIO Special report.

Jan 07, 2022

PERSPECTIVES Special

Artificial Intelligence: getting around Moravec's paradox?

Our new CIO Special looks at why AI technology is now advancing fast, and the evolution of the sector from an investor’s perspective.

Nov 02, 2021

PERSPECTIVES Special

Smart Mobility: transportation reinvented

In our new CIO Special, we look at the major ongoing transformation of our transportation infrastructure.

Nov 01, 2021

PERSPECTIVES Special

Natural capital and biodiversity: measurement and investment

Our special report looks at the topic of biodiversity from a natural capital perspective, and provides insights into how we can start to tackle the “triple planetary crisis” around climate, nature and pollution. With a preface by Professor Sir Partha Dasgupta, Frank Ramsey Professor Emeritus of Economics at the University of Cambridge.

Oct 12, 2021

/cio_social_justice_3.jpg)

PERSPECTIVES Special

What our concept of social justice should be

The ongoing climate crisis, the loss of biodiversity and the degradation of ecosystems combine to form the greatest social challenge that we face

Oct 05, 2021

PERSPECTIVES Special

Venture Capital Investing: returns and diversification

Our latest CIO Special report Venture Capital investing: returns and diversification discusses how the sector is developing and its role in portfolios. Read more.

Sep 08, 2021

PERSPECTIVES Special

Coastlines in crisis: key risks from rising oceans

Rising seas will compound other effects from climate change and ocean degradation. They will have major implications for the overall macroeconomic and policy outlook, and for investment.

Sep 01, 2021

PERSPECTIVES Special

Millennials: ageing pains

Millennials form an increasingly important group in many economies, in both economic and political terms. Our new CIO Special report looks at trends that are shaped by the Millennial generation and how investors can benefit from them.

Jul 23, 2021

CIO podcast

The deep sea: Earth’s final frontier for exploration and sustainable development

Doug McCauley, professor of ocean science at the University of California Santa Barbara and director of the Benioff Ocean Initiative, joins Markus Müller, head of the Chief Investment Office at Deutsche Bank's International Private Bank, to discuss the deep sea and the importance of taking a long-term, sustainable approach to its development.

Jul 05, 2021

PERSPECTIVES Special

Biodiversity loss: recognising economic and climate threats

Our latest CIO Special looks at the importance of biodiversity and presents the results from our survey of investor attitudes towards environmental, social and governance (ESG) investing.

May 18, 2021

PERSPECTIVES Special

Empowering the blue magic: act today for tomorrow

Our new CIO ESG Special provides an intuitive and easy-to-use summary of our previous special report on the blue economy.

Mar 13, 2021

Future Fundamentals podcast

Medtech: the future of healthcare beyond COVID-19

University of Oxford professor and medical device innovator Constantin Coussios joins Deutsche Bank’s Christian Nolting to discuss how digitalisation and demographics are converging to improve lives and create investment opportunities.

Feb 25, 2021

PERSPECTIVES Special

Exploring the E, S and G in ESG

Our new CIO Special report looks at the history of global sustainability initiatives, for example around climate change, biodiversity and the blue economy. Read more..

Dec 05, 2020

PERSPECTIVES Special

The “G” in ESG: Governance – a question of balance

Our CIO Special looks at the evolution of the concept of governance (“G”), the final ESG component along with environmental (“E”) and social (“S”) factors.

Aug 12, 2020

PERSPECTIVES Special

The "S" in ESG: the ugly duckling of investing

In this CIO Special report we show how social criteria are becoming an integral part of informed investment decisions.

Nov 18, 2019

See more

ESG special reports

ESG

ESG investment performance: drivers and management

This PERSPECTIVES Special explores the nuances behind the numbers, showing that ESG performance depends heavily on how it's defined, implemented and measured. Read for more details today.

ESG Special

ESG and Sustainability Market Monitor

The client-ready ESG and Sustainability Market Monitor helps you stay informed and up-to-date on the latest developments in environmental, social and governance (ESG) investing and the transition to more sustainable economies.

PERSPECTIVES Special

ESG Survey 2024: Investing in the sustainable transition

Our 4th annual ESG Survey shows that investors are already investing in the sustainable transition, with evolving views on what are likely to be the leading future sectors and return drivers. Fueled by pragmatism as well as principles, ESG investment is happening. Read more.

.jpg)

PERSPECTIVES Special

ESG Survey 2023: Sustainable transition and investment

Over the last three years, our annual survey has examined our private, business and institutional clients’ attitudes to the multiple dimensions of ESG (environmental, social and governance) investing. This year, we had 1,759 responses to our survey, double the 849 received in 2022.

PERSPECTIVES Special

ESG & investment performance: think strategically

The key to sustained long-term returns from ESG investment is effective strategic asset allocation.

PERSPECTIVES Special

Smart mobility: switch, optimise, prioritise

Once we looked to technology to make transportation systems cheaper, faster or safer. But “smart mobility” needs to be more sustainable too - and the primary challenge may be social in nature.

PERSPECTIVES Special

ESG Survey 2022: Trends and concerns

In this year's survey we asked almost twice as many questions, with the aim of getting a more complete view of our private, institutional and business clients’ attitudes to ESG.

PERSPECTIVES Special

Commodities, the energy transition and ESG portfolios

Energy price volatility has had an obvious impact on ESG portfolios this year, but we also need to consider the longer-term dynamics around energy and commodity markets.

PERSPECTIVES Special

Ensuring a sustainable blue economy

The Ocean provides key ecosystem services that are crucial for human wellbeing and the prosperity of the global economy. Learn more on how a sustainable blue economy could be implemented.

PERSPECTIVES Special

Energy and Asia: future challenges

Our CIO Special looks at the rapidly growing Asian energy market and how policymakers are trying to satisfy growing demand – while also reducing carbon emissions and improving energy security.

PERSPECTIVES Special

India: on the cusp of energy transition

In this CIO Special we look at the remarkable progress that India has achieved in its energy transition from fossil-fuel based sources to sustainable and green ones.

PERSPECTIVES Special

Nature-based Solutions and the climate crisis

Nature-based Solutions (NbS) will help us tackle the climate crisis. But to fully harness their potential, we need a precise conceptual understanding of what they are and the benefits they provide.

CIO Nature Series

Corals: the rainforests of the sea

This introductory guide to the global threats facing coral reefs – and what we can do to reduce them – is part of our new CIO Nature Series providing insights on nature-based solutions to address climate impacts and foster adaptation efforts.

PERSPECTIVES Special

Ocean finance: redefining the value chain

As we mark the UN’s World Oceans Day for 2022, we face major challenges in building a sustainable blue economy. This CIO Special, produced in collaboration with the Ocean Risk and Resilience Action Alliance (ORRAA), explains how the global financial sector will play an important role in finding solutions.

PERSPECTIVES Special

Biodiversity: the new playing field for ESG assessment

Our CIO Special looks at likely future trends in ESG assessment and why biodiversity will be an increasingly important consideration.

PERSPECTIVES Special

Natural capital and biodiversity: measurement and investment

Our special report looks at the topic of biodiversity from a natural capital perspective, and provides insights into how we can start to tackle the “triple planetary crisis” around climate, nature and pollution. With a preface by Professor Sir Partha Dasgupta, Frank Ramsey Professor Emeritus of Economics at the University of Cambridge.

PERSPECTIVES Special

Coastlines in crisis: key risks from rising oceans

Rising seas will compound other effects from climate change and ocean degradation. They will have major implications for the overall macroeconomic and policy outlook, and for investment.

PERSPECTIVES Special

Biodiversity loss: recognising economic and climate threats

Our latest CIO Special looks at the importance of biodiversity and presents the results from our survey of investor attitudes towards environmental, social and governance (ESG) investing.

PERSPECTIVES Special

Empowering the blue magic: act today for tomorrow

Our new CIO ESG Special provides an intuitive and easy-to-use summary of our previous special report on the blue economy.

PERSPECTIVES Special

Exploring the E, S and G in ESG

Our new CIO Special report looks at the history of global sustainability initiatives, for example around climate change, biodiversity and the blue economy. Read more..

PERSPECTIVES Special

Understanding the blue economy

In this special report we look at what exactly the blue economy is, and why it remains crucial for biodiversity and the sustainability of global economic development.

PERSPECTIVES Special

The “G” in ESG: Governance – a question of balance

Our CIO Special looks at the evolution of the concept of governance (“G”), the final ESG component along with environmental (“E”) and social (“S”) factors.

PERSPECTIVES Special

The "S" in ESG: the ugly duckling of investing

In this CIO Special report we show how social criteria are becoming an integral part of informed investment decisions.

Podcasts

CIO Podcast

PERSPECTIVES Weekly podcast: September 15 – Fed watch: waiting for a rate cut

Markets are anticipating a policy shift this week from the Federal Reserve, which is expected to deliver the first of several rate cuts that could be spread out over the next year, says Dr Dirk Steffen, the Private Bank’s EMEA CIO. “It looks like the US central bank is now pondering the labour market much more,” Dirk says, pointing to weak jobs data to explain why the Fed might look beyond a recent uptick in consumer prices.

Future Fundamentals podcast

Putting nature on the balance sheet

In our Future Fundamentals podcast, Naoko Ishii, Executive Vice President of the University of Tokyo and Director of the Center for Global Commons, and Markus Müller, our Chief Investment Officer for Sustainability, discuss putting nature on the balance sheet and how to build a coordinated financial response to this global challenge.

Future Fundamentals podcast

Investing in the Blue Economy: a blueprint for action

In our Future Fundamentals podcast, Karen Sack, of ORRAA, and Markus Müller, our Chief Investment Officer for ESG, take a deep dive into the sustainable blue economy.

Future Fundamentals podcast

Sustainable cities

The Private Bank’s ESG CIO Markus Müller and Dr. Philipp Rode of the London School of Economics (LSE) look at how cities can adapt to increasing social, economic and environmental pressures in an ever-more urbanised world.

Future Fundamentals podcast

Measuring sustainability

Deutsche Bank Private Bank’s ESG CIO Markus Müller and Anna Katharina Mayer, Club of Rome member and FindingSustainia co-founder, look at the complex issues around measuring sustainability – in other words, how we assess the real impact of corporate, government and individual actions on the natural world around us.

Future Fundamentals podcast

Sustainable value chains

Deutsche Bank Private Bank's ESG CIO Markus Müller and Deutsche Bank Research’s Marion Laboure look at value chains in the global economy – and why there are increasing concerns about their sustainability.

Future Fundamentals podcast

Sovereign carbon credits

Claire Coustar of Deutsche Bank’s Investment Bank joins Markus Müller, Chief Investment Officer ESG & Global Head Chief Investment Office at Deutsche Bank's Private Bank, to discuss the recent evolution of the sovereign carbon credits market and how it will help us value and protect natural assets.

Future Fundamentals podcast

The future of work and the ReRo revolution

Marion Laboure, Senior Economist at Deutsche Bank and Research Lecturer at Harvard University, joins Markus Müller, Chief Investment Officer ESG & Global Head Chief Investment Office at Deutsche Bank's Private Bank, to discuss the continuing process of workplace change and the Remote working and Robotics (ReRo) revolution.

CIO podcast

The deep sea: Earth’s final frontier for exploration and sustainable development

Doug McCauley, professor of ocean science at the University of California Santa Barbara and director of the Benioff Ocean Initiative, joins Markus Müller, head of the Chief Investment Office at Deutsche Bank's International Private Bank, to discuss the deep sea and the importance of taking a long-term, sustainable approach to its development.

Future Fundamentals podcast

Medtech: the future of healthcare beyond COVID-19

University of Oxford professor and medical device innovator Constantin Coussios joins Deutsche Bank’s Christian Nolting to discuss how digitalisation and demographics are converging to improve lives and create investment opportunities.

Future Fundamentals Podcast

Biodiversity loss: how many extinctions add up to economic collapse?

Acclaimed marine biologist and coral expert Kristen Marhaver joins Markus Müller, head of the Chief Investment Office at Deutsche Bank's International Private Bank, for the first episode of our Future Fundamentals podcast, designed to explore the long-term investing implications of today's key issues.