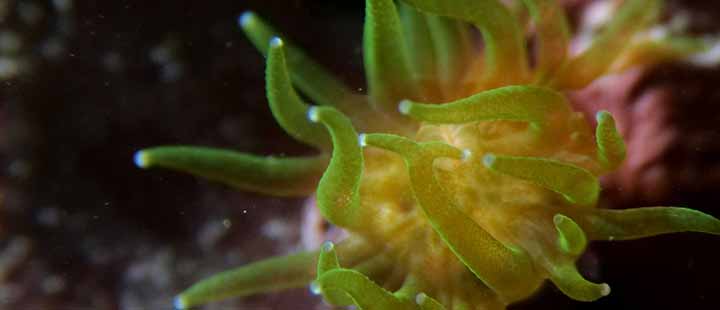

Biodiversity is in decline, threatening the ecosystems that sustain the world we live in and that make economic prosperity possible.

At Deutsche Bank, we recognise biodiversity loss is a key environmental concern with major economic implications. Our in-house experts and guest contributors regularly produce events and content designed to clarify the links between our financial future and our planet’s natural capital.

.webp)