Introduction

In our fourth annual CIO survey of ESG investing, we explore attitudes to ESG, the management of ESG in portfolios and expectations on the sustainable transition. We’ve had over 1,300 responses to the survey from our Private Bank and Wealth Management clients. The survey was conducted over two months between April 30th to June 30th this year.

ESG investment remains a rapidly evolving area – in terms of products, regulation and information. The aim of our survey has always been to establish clients’ attitudes towards ESG investment as well as their views on environmental priorities and policy more broadly.

The report on the results of our 2024 ESG investment survey is divided into three sections: ESG as a measure of sustainability, the implementation of ESG factors in portfolios, and the likely future investment drivers of the sustainable transition.

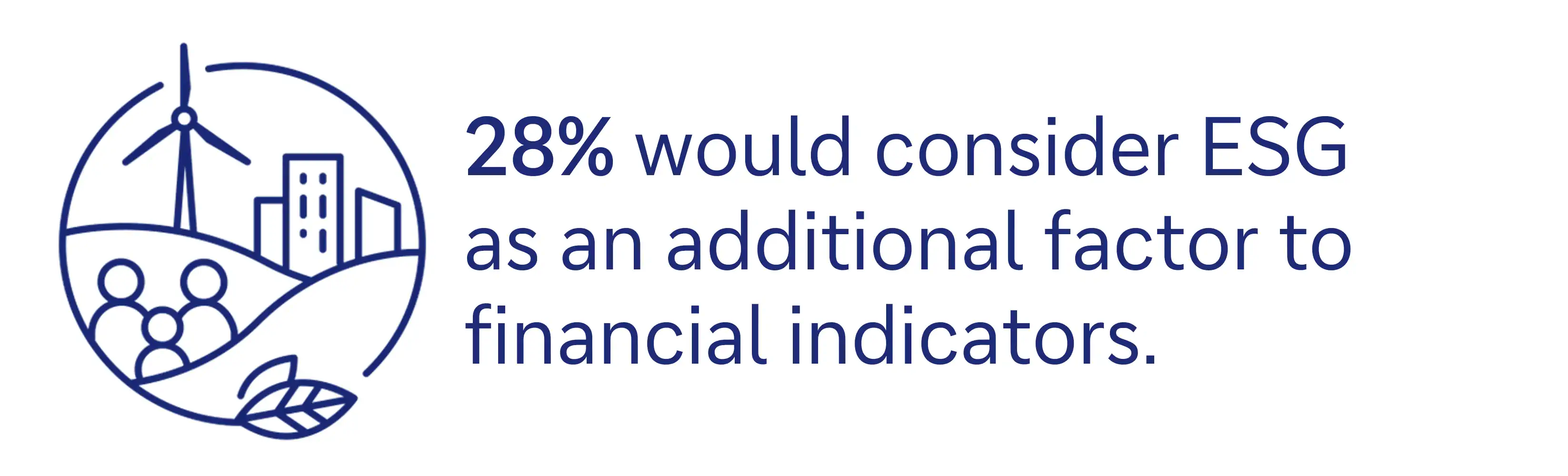

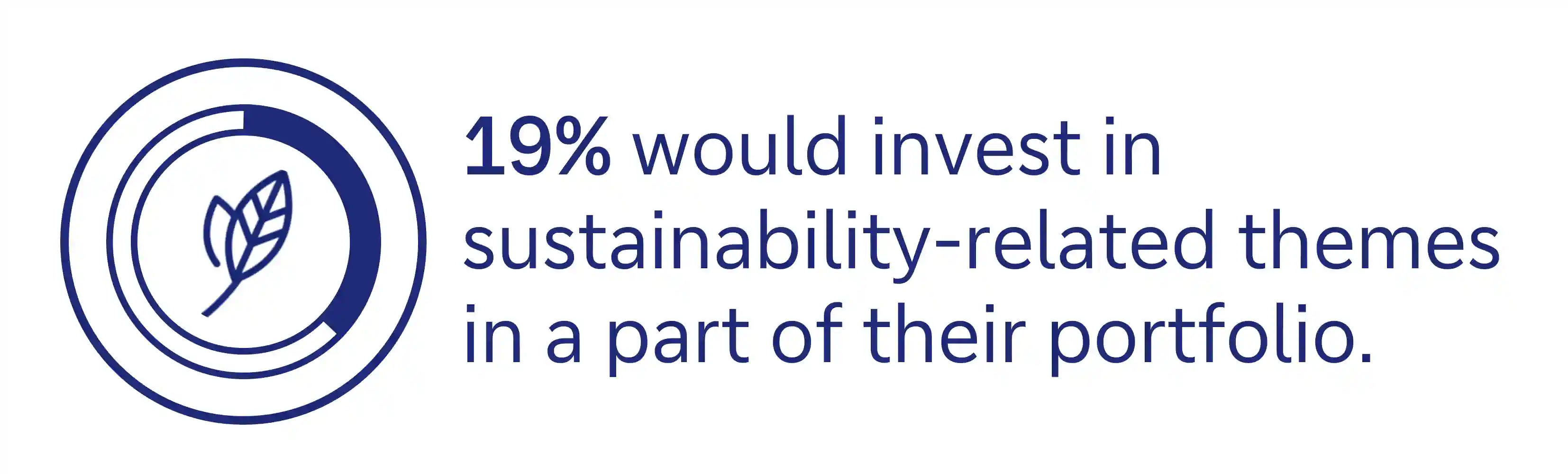

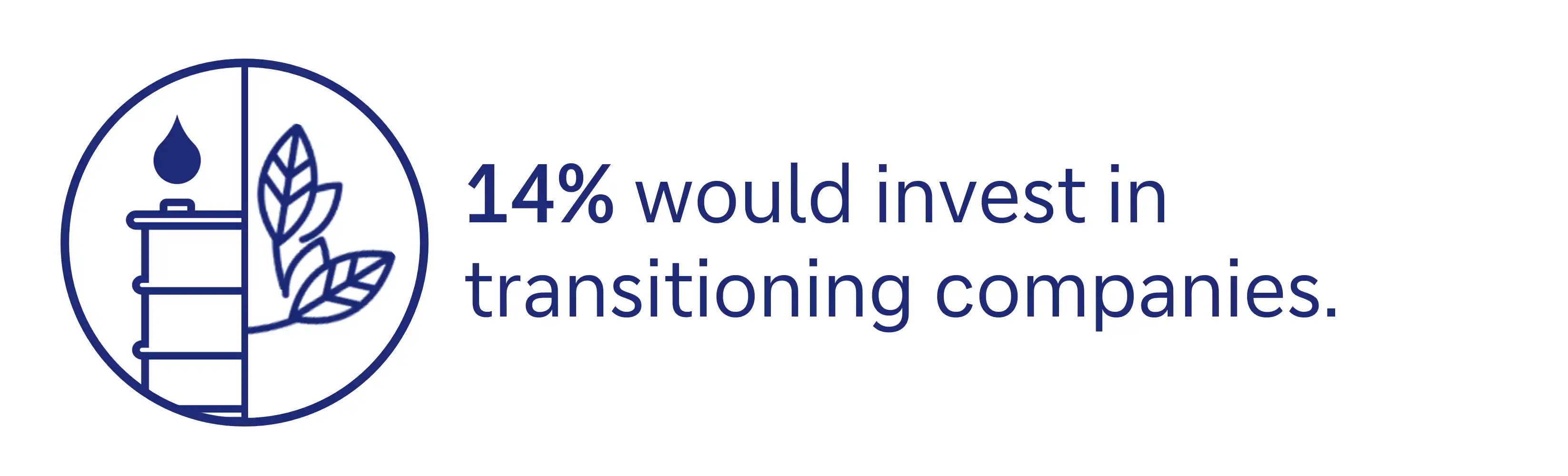

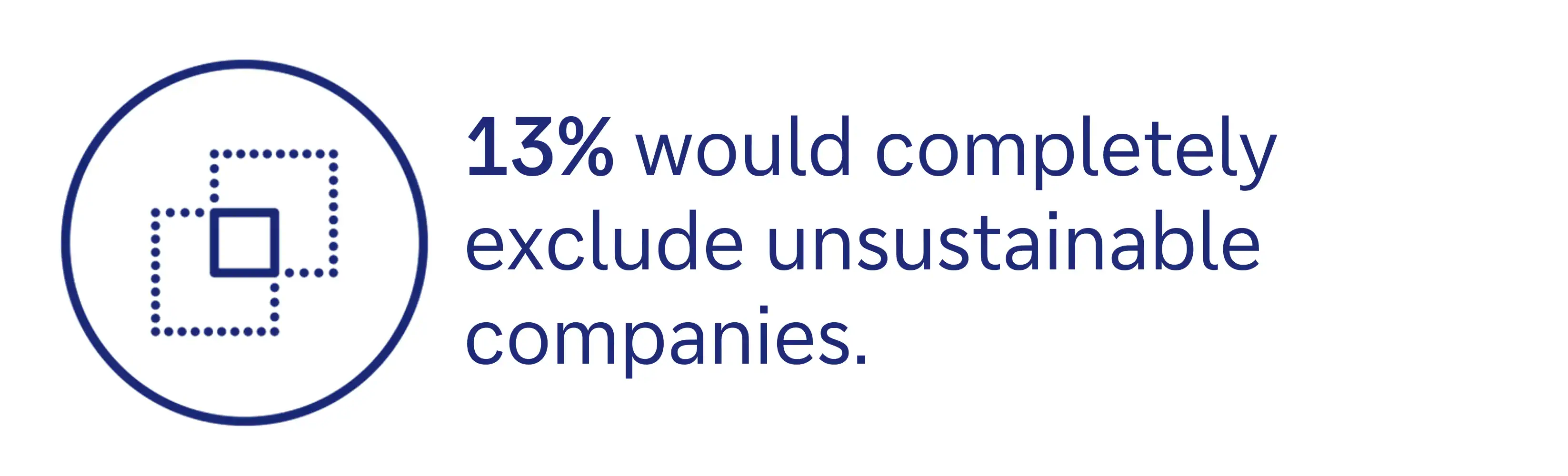

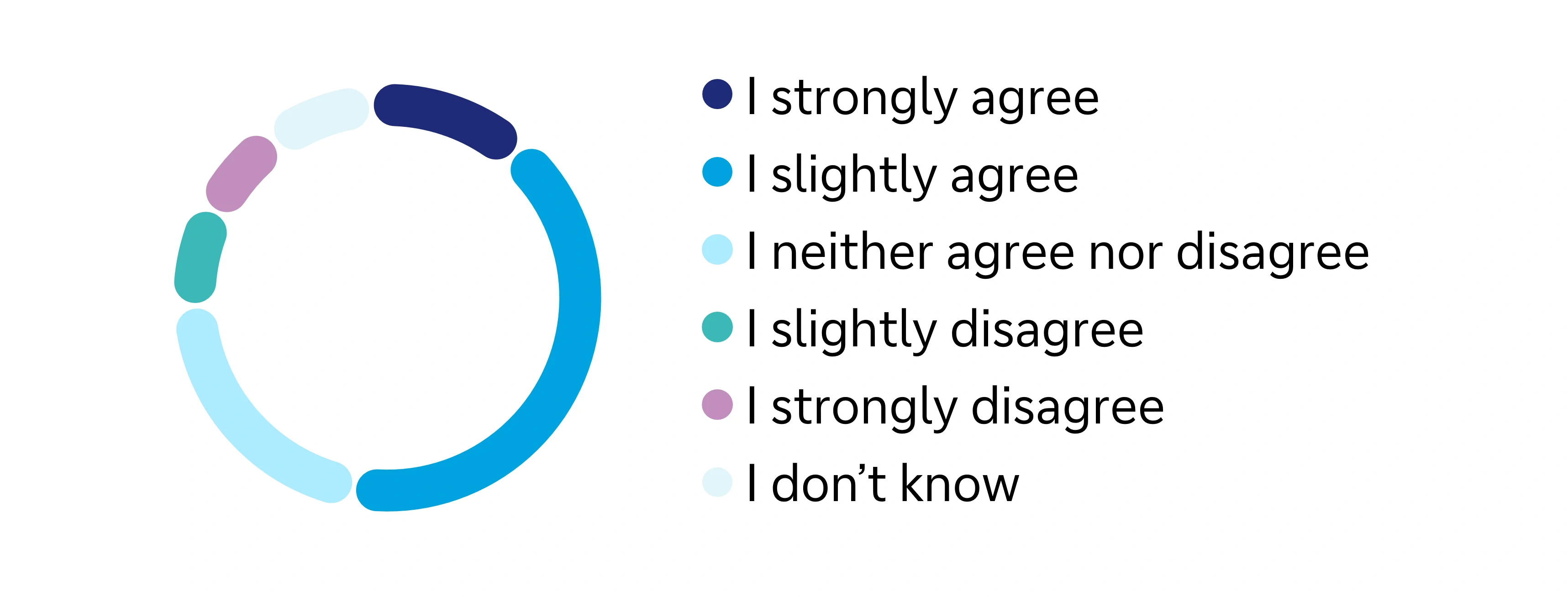

To our question "To what extent would you consider sustainability in your portfolio?", our clients answered as following:

Five key findings

- Investors still think they lack ESG investment knowledge and skills – just 3% classify themselves as advanced ESG investors, with a further 15% thinking they have a good knowledge of the subject. Preferences for ESG investment vehicles also vary considerably.

- 47% of respondents said they didn't have just one specific ESG portfolio objective, with a high priority (19%) given to “fairer society” as well environmental considerations.

- 28% of respondents want to use ESG as an additional factor to financial indicators when considering an investment.

- Only 7% of respondents want to invest their portfolio entirely with sustainability considerations.

- On balance, investors expect to increase the share of ESG investments in their portfolio, but there is scepticism about the ability of ESG investing to boost returns and manage risk.

Here is how our clients reacted to the statement "I expect to increase the share of sustainable investments in my portfolio over the next five years":

Key takeaways

- While environmental factors remain a focus for investors, the survey shows increasing attention to social and governance aspects. Investors are often pursuing multiple goals such as creating a fairer society and enhancing governance. This multifaceted approach supports the case for a balanced assessment of all three ESG pillars.

- There is a clear intention to increase the share of sustainable investments in portfolios, with over half of respondents planning to boost their ESG allocations in the next five years. However, concerns about risk and return remain widespread, with some investors questioning the short-term performance of ESG investments, particularly in volatile markets.

- Investors expect different sectors to be performance leaders, depending on the time frame. In the short term, technology and digitization are expected to perform best, while sectors like healthcare and infrastructure are projected to do well in the medium term. Over the long term, the Blue Economy is expected to have the highest returns because environmental factors are expected to increasingly influence investment returns.

These results show that ESG investment remains appealing and reminds us that environmental considerations will be accompanied by social and governance objectives too. There is some uncertainty about what ESG really means for portfolios in terms of performance, risk and investment vehicles, but these results show investors are already investing in the sustainable transition.

Markus Müller

Chief Investment Officer Sustainability & Global Head of Chief Investment Office of Deutsche Bank Private Bank