Introduction

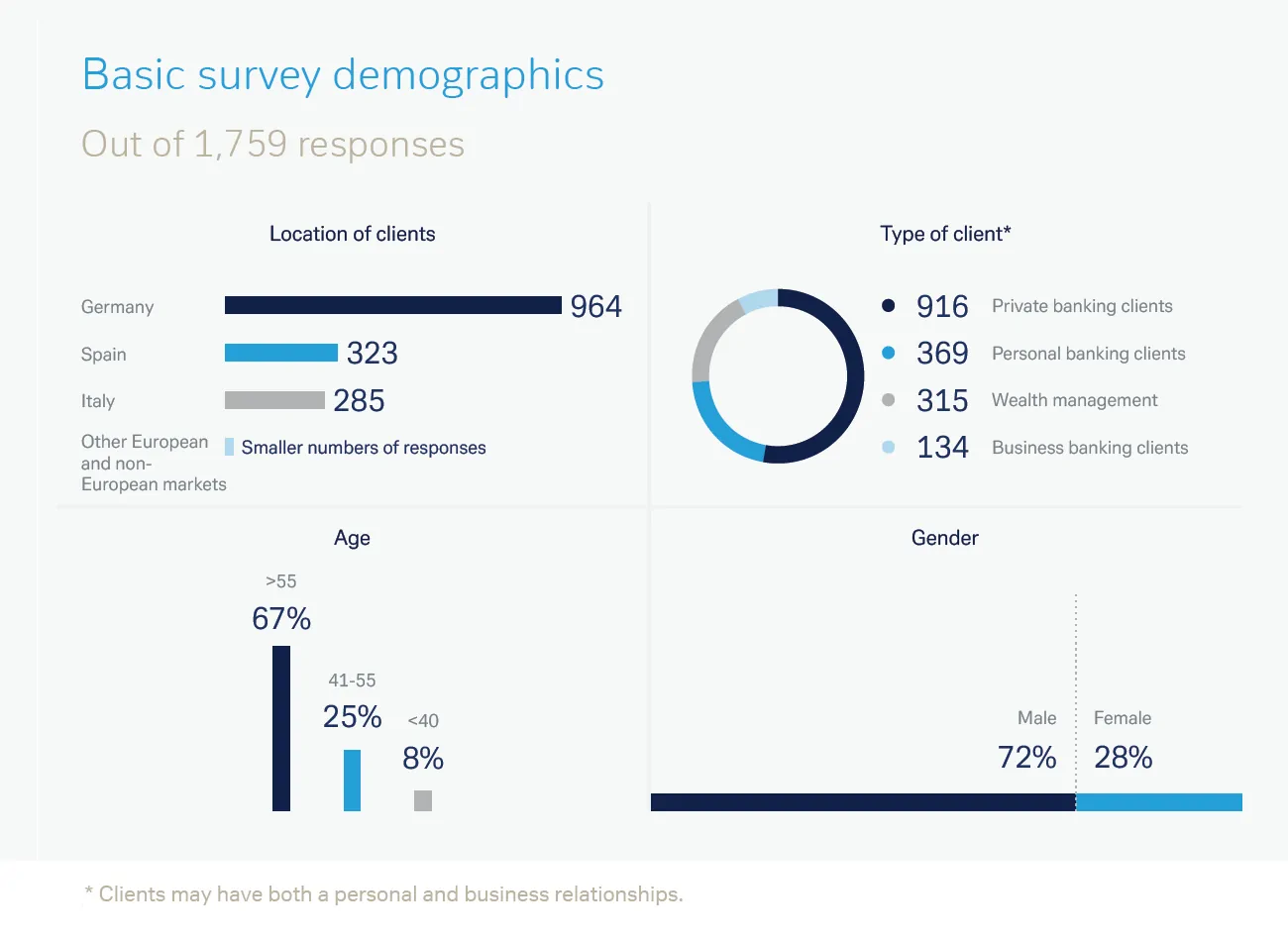

Over the last three years, our annual survey has examined our private, business and institutional clients’ attitudes to the multiple dimensions of ESG (environmental, social and governance) investing. This year, we had 1,759 responses to our survey, double the 849 received in 2022. The survey was conducted between the beginning of June and the end of July this year.

ESG investment remains a rapidly evolving area – in terms of products, regulation, information and so on. The aim of our survey has therefore always been not only to establish clients’ attitudes to ESG investment, but also their views on environmental priorities and policy more broadly. This year’s survey continues with this twin-pronged approach, also looking in detail at client opinions on specific markets.

We discuss 10 key findings from the survey below, divided into the two areas of the sustainability transition to a less environmentally-damaging economic model and ESG investing approaches.

What general conclusions can we take from this year’s survey? We would highlight two. Firstly, that investors remain strongly focused on sustainability. They are concerned about what will be needed to transition to a more sustainable economy, corporate disclosure and the preferable policy approaches. Secondly, that ESG investment must show it can deliver on investor needs. Investors expect environmental change to impact individual asset classes and think that nature will be a key factor in individual investment decisions. But they are getting slightly more sceptical about ESG investment’s ability to improve portfolio returns and manage risk: new approaches are needed, including on portfolio management.

10 key findings of 2023

The sustainability transition

1.

Investors prefer market-driven solutions to more regulation. Technology, production processes and consumer education are preferred ways to achieve a sustainable economy.

2.

Investors expect transition opportunities particularly in the energy transition. AI, sustainable manufacturing, the circular economy and infrastructure are also among the areas that are seen as interesting opportunities.

3.

More corporate transition information is wanted although our business clients report an increasing number of sustainability/ESG plans. Disclosure requirements are not on balance seen as a burden.

ESG investment approaches

4.

Transition is the investor focus – not exclusion. Few investors would completely exclude companies that do not act sustainably, or only invest in sustainability leaders.

5.

ESG is still seen as an additional factor to financial indicators. However, we believe that the distinction between ESG and traditional financial indicators will become less relevant over time.

6.

Climate risks will impact risk/return profiles of asset classes. Equities are expected to experience greater sensitivity in the long term.

7.

Nature will become a more important investment factor. Investors think we need to consider a company’s dependence on nature, as well as its impact on the environment.

8.

Few investors consider themselves ESG experts. Just 3% of respondents identified as ESG experts, and only 15% thought they had a good knowledge of it – investor education is needed.

9.

Many investors still think ESG can improve portfolio returns but doubts are growing. Recent events and macroeconomic shifts have had an impact here.

10.

Faith that ESG can manage portfolio risk is waning. 37% of respondents strongly or slightly agree that considering ESG factors can manage portfolio risk, a lower share than last year.

.jpg)

.webp)