Annual Outlook 2024 – Sectors: Banking on tech

U.S. growth stocks are probably still the way to go for the long term. European and Japanese financials could appeal too, as well as consumer discretionary, industrials and energy.

While we expect single-digit percentage price gains by the lead indices in the major equity markets in 2024, it could be worthwhile for investors with a greater appetite for risk to look below the surface of the indices at the individual sectors in search of higher returns.

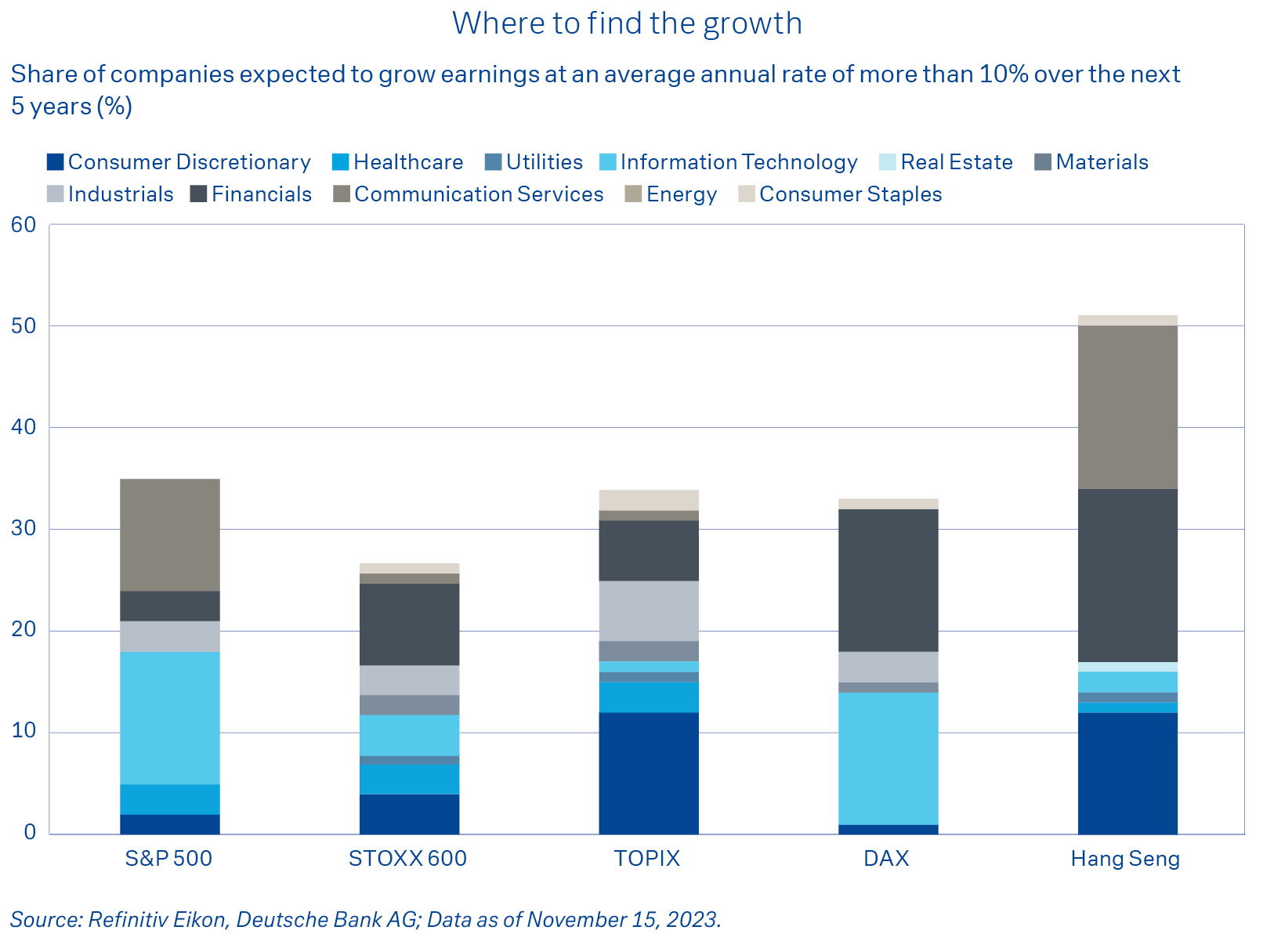

In an environment of weak global economic growth, the focus should remain on growth stocks, i.e. those that have proven to grow earnings at an above-average rate compared with the market as a whole. These are found mainly – but not exclusively – in the U.S. However, a closer look shows Europe and Asia are home to many growth companies as well.

Generally speaking, we think large cap stocks should continue to outperform their smaller peers as they are less sensitive to interest rates. Only once interest rate headwinds subside and a more sustained economic recovery is visible should small cap stocks be able to make up ground.

- U.S. growth stocks are highly valued, justifiably in our view (highly profitable firms).

- Weak global economic growth, remaining growth segments/growth stocks in demand.

- Industrials, consumer discretionary and financials (insurers & banks) – focus on Europe.

From a regional perspective, the U.S. equity market is particularly attractive for investors when it comes to growth companies – thanks to its global leaders in IT, communication services and discretionary consumer goods, including electric vehicle producers and online retailers. It is these highly profitable major corporations in particular that have again contributed the lion’s share to the S&P 500 gains this year.

We therefore currently see little reason why this should change in the year ahead. The U.S. offers investors the world’s greatest access to companies in future-oriented sectors such as artificial intelligence, cloud computing, software and hardware. However, this quality comes at a price. The valuations of U.S. technology companies are high – but so are their margins and return on equity (RoE).

For other growth sectors, it might be a good idea to look at the more favourably valued European equity markets. This applies to industrial stocks, for example. Moreover, there are many global market leaders here, particularly among the companies involved in the green transformation of the economy – for example, in the areas of renewable energy and semiconductors. In addition, Europe has a very strong luxury goods sector which we again view more positively in the long term in anticipation of improving global consumer sentiment.

In an environment of moderate economic development, the focus is likely to remain on growth stocks, whose earnings outperform those of the market as a whole.

Investors could also add the financial sector (insurers and banks) to their watch list. With their deposit and credit business, banks in particular are likely to continue benefiting from the higher interest rate regime while investment banking should start to recover in anticipation of no further interest rate hikes. In Europe, bank shares are currently valued at a particularly low level with a P/E ratio of six times expected earnings over the next 12 months.

A mix of dividends and share buybacks could deliver an attractive shareholder return in the low double-digit percentage range in 2024. We take a similar view of trends in Japan. U.S. banks are already valued quite highly compared to their international peers and face elevated regulatory scrutiny. Insurance sector stocks are slightly more defensive than bank shares but are equally attractive.

Overall, we see less upside potential for defensive sectors such as utilities, healthcare and consumer staples, i.e. traditional defensives and bond proxy stocks. The latter have the classic characteristics of bonds – stable returns and lower volatility – and are therefore considered by some investors to be a higher-yielding alternative to bond investments. However, due to the increase in bond yields, the migration from these equity segments could continue in 2024 – although a clear distinction must be made between individual companies.