Annual Outlook 2024 – Risks: De-risking risks

Be aware that measures to create stability may just create new risks. Rates are still on our radar.

Disruptions to global supply chains were some of the biggest risks to global trade and the global economy, and therefore also for the capital markets, after the outbreak of the Covid-19 pandemic in early 2020 and again after the start of the Russia-Ukraine war in February 2022.

The Global Supply Chain Pressure Index (GSCPI), which is published by the Federal Reserve in New York and tracks the pressure on global trade flows, reached its absolute peak at the end of 2021. Although the GSCPI fell to its all-time low in Q1, it has risen slightly since then. Political and business decision-makers are still aware of the potential risks of supply chains being interrupted again.

A buzzword that is often heard in this context is ‘de-risking’, the intended reduction of trade risk. This includes partial or full relocation of production capacity to the original country (reshoring), to neighbouring economies (nearshoring) or to countries with favourable political and economic relations (friend-shoring). What seems sensible, however, is not without risk.

- Measures meant to stabilise supply chains may harbour new risk.

- Societies / politicians still calling for de-risking/ friend-shoring/ nearshoring.

- Beware the bond market: volatility may stay high and affect stocks and other asset classes.

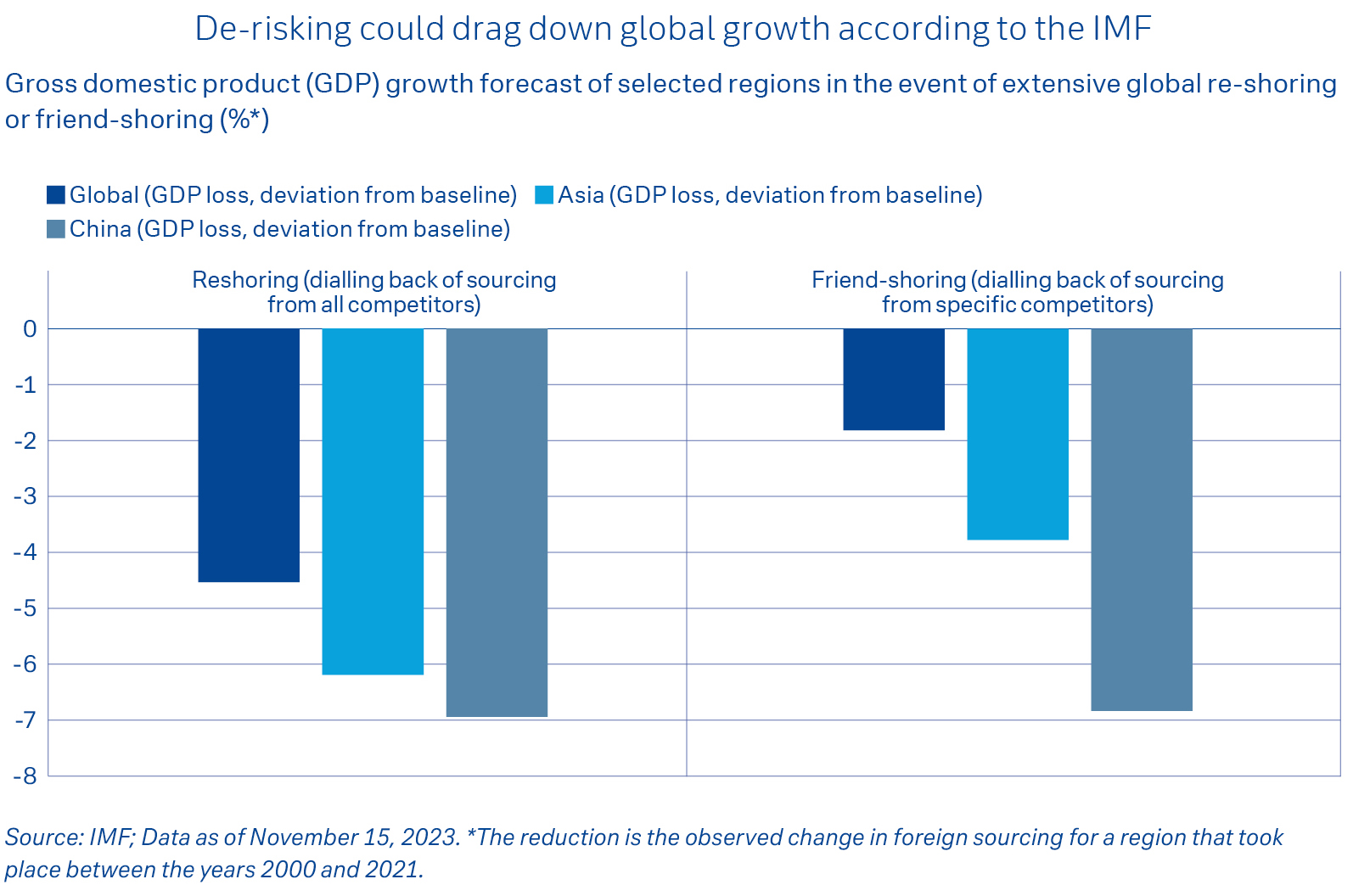

The International Monetary Fund, for example, has calculated that extensive reshoring and friendshoring would drag down growth significantly, for example by reducing margins – for the economies involved as well as for the global economy as a whole. This is, for example, because companies would need to pay higher wages and operate under stricter regulation.

What’s more, potential new partners – India and Mexico in particular are often mentioned in this context – are finding that their growing economies and populations put them in a stronger position to pursue their own interests – both politically and economically. This may mean that manufacturers relocating to such countries will have to design different versions of their products for different jurisdictions and markets, weighing on their margins.

Other risk areas that should be monitored closely in 2024 are the high fiscal spending of many countries, which is connected to the extensive investment packages to manage the green transformation of their economies and to the increasing global competition for access to natural resources.

Also at the top of our watchlist are the current and expected geopolitical challenges, which may result not only in human suffering, but also tangible economic consequences. They include the Russia–Ukraine war and its impact on global food and energy security, Israel’s war against Hamas and the possible impacts on oil production in the region, the tension between China and Taiwan, the world’s most important producer of computer chips; and the ongoing battle between China and the U.S. for technology leadership.

Important elections are scheduled in a total of 40 countries around the globe with a combined population of more than 3 billion people in 2024. These countries account for 42% of global gross domestic product. The uncertain outcomes of these elections in the U.S., India, Russia and the EU, for example, are a major source of additional risk, especially as domestic political developments in many countries appear to have an increasingly tangible impact on their respective foreign policy decisions.

While our view on bonds is constructive from an overall investor’s perspective, the bond market remains under particular scrutiny. Uncertainty about the details of the Fed and ECB‘s future rate paths and the resulting adjustments of market participants‘ interest rate expectations are likely to continue to have a significant impact on asset prices.

Extensive reshoring and friend-shoring would drag down growth significantly – for the economies directly involved as well as for the global economy as a whole.