Annual Outlook 2024 – ESG: We‘re in this together

ESG investment has gone mainstream, with performance implications. Energy transition may point the way to investing in the sustainable economy.

Please note: this article is more than one year old. The views of our CIO team may have changed since it was published, and the data on which it was based may have been revised.

The investment impact of ESG remains complex but important to understand. Consider for example the energy sector and the process of “energy transition” to more sustainable sources.

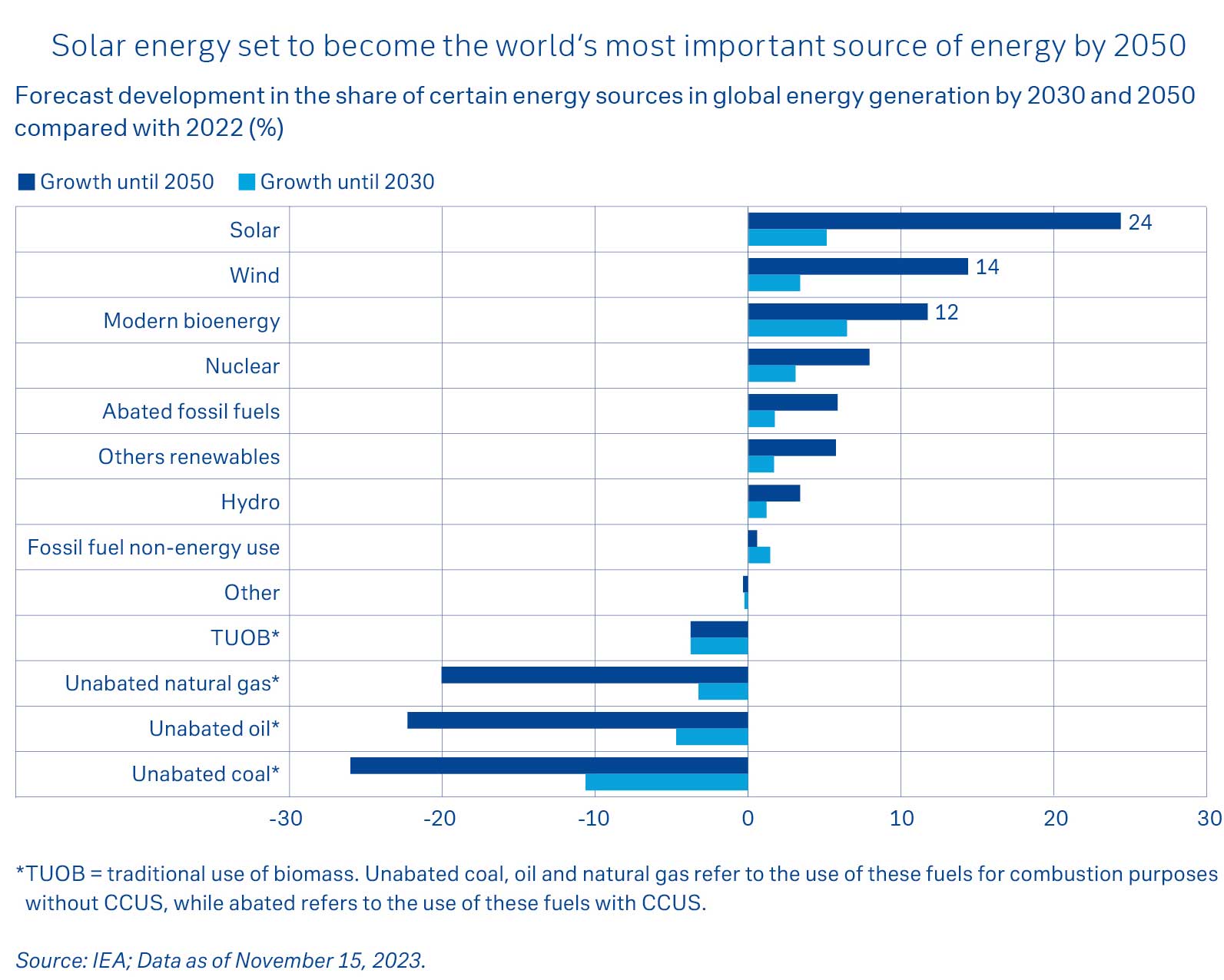

Renewables and clean energy now constitute the accepted transition path away from fossil fuels and solar and wind capacity continues to rise. Some 55% of respondents to our own recent ESG client survey identify the energy transition as one of the three most interesting areas for investors. But the recent performance of clean energy stocks (and associated funds) has often been disappointing, relative to that of some traditional hydrocarbon producers.

- Renewables and clean energy are the accepted path in the energy transition.

- However alternative energy producers may still face investment headwinds.

- Understanding ESG investment characteristics remains the key to managing ESG investment’s ability to improve portfolio returns and manage risk.

Sustainability is part of our lives and our recent investor survey suggests that investors remain strongly focused on it.

To some extent, it can be argued that recent clean energy investment setbacks are a sign of the sector’s success. Clean energy is now accepted as mainstream and the fact that it can be classified as ESG investment does not mean that it is immune from normal market and investment considerations.

Just like existing hydrocarbon-based firms, clean energy producers are subject to shifting patterns in demand and supply. When supply is tight (e.g. due to the recent disruption in the supply of Russian energy), energy prices go up and suppliers can prosper. But when supply issues are resolved (or, for other reasons, demand dips) then energy prices will fall with implications for all energy firms’ profitability.

Alternative energy producers can face particular problems from such shifts in energy prices – and from their implications for whether or not investment will deliver acceptable returns. But clean energy start-ups are also vulnerable to changes in the investment environment itself. Many have been a victim of rising interest rates. Start-ups (in energy or other areas) require debt and higher interest rates can jeopardise their ability to service this.

In addition, start-up firms’ valuations are often more highly dependent on anticipated future revenue flows than those of incumbents. The more interest rates rise, the more these future flows have to be discounted, reducing a firm’s appeal to investors.

As a result, many clean energy stocks’ underperformance this year may say more about the rates environment than underlying investor appetite for the green transition. But, whatever the fundamentals, the danger is that such shifting sentiment can then cause stock markets to serve as short-term “voting machines” rather than long-term “weighing machines”, to borrow the observation of 20th century economist and investor, Benjamin Graham. Markets vote against a particular sector despite its long-term prospects remaining positive.

Clean energy may provide a bellwether for the investment experience of other ESG sectors driving the transition to a more sustainable economy. Energy is the leading indicator because it meets a key human demand. Fixing it must be central to decarbonisation efforts as it currently accounts for around three quarters of human induced carbon emissions, and we have already had most of the technology to do so. This is a question of implementation, not technological speculation.

There are three lessons for 2024 investments from this year’s energy stock performance. First, that we should realise that ESG investment will suffer from many of the same positives and negatives as non-ESG investment. In some cases, temporary headwinds can in fact be worse for ESG investment. Debt burdens, as in any evolving sector, can also trigger a process of market consolidation where only a few major industry players survive – something that has been recently evident in the offshore wind sector.

Second, when looking at investment performance, we need to be careful to take a macro perspective. Over the longer term, the hydrocarbon sector’s market performance still suggests an industry in decline. Risks around “stranded assets” – environmentally problematic resources which regulation or other factors make economically unviable – are very likely to grow.

Third, clean energy and other ESG investments should always be considered in relation to the process of a sustainable transition. Focusing only on exclusion (e.g. not investing at all in any hydrocarbons) may hinder rather than help this transition process. At some point, it may make more sense, in terms of both environmental and financial returns, to invest in existing firms with non-ESG assets that are committed to a path of environmental improvement and carbon reduction (and an ability to show transparent results).

As mentioned by the International Energy Agency (IEA), the transition to a clean energy system will be independent of established energy companies, but their involvement could make this transition faster and less costly. Such firms may be able to use balance sheets, existing sales networks and cash generation to deliver rather different return characteristics for investors.

What are the other lessons for the future? Sustainability is part of our lives and our recent investor survey suggests that investors remain strongly focused on it. They are concerned about what will be needed to transition to a more sustainable economy and what will be the best policy approaches. But there is also a need for ESG to show that it can deliver on investment needs. Investors already expect environmental change to impact individual asset classes and there is now a need for portfolio construction to show how it will incorporate this.

Understanding ESG investment characteristics remains the key to managing ESG investment’s ability to improve portfolio returns and manage risk. Our survey also suggests a preferred investor focus on transition, not exclusion, and we expect credible transition planning to play a dominant role in ESG investment in future.