Since the 1870s, Deutsche Bank has focused its wealth management services on commercially minded individuals and families with European connectivity.

Deutsche Bank's business as a wealth manager is almost as old as the bank itself. One of its founding objectives was "to promote and facilitate trade relations between Germany and other European countries and overseas markets", and that meant supporting German entrepreneurs in their activities around the world. Naturally, these pioneering exporters and international traders came to rely on the bank for support with their personal financial affairs.

Bankers in the Berlin office in the late 19th Century would often become executors or estate administrators for wealthy clients, in addition to carrying out their everyday roles. The head of Deutsche Bank's Potsdam branch acted as financial adviser to the German royal family for years, and continued in this role even after he retired from the bank.

How Deutsche Bank grew its global wealth management network

The first private clients of Deutsche Bank opened their accounts for deposits and securities in July 1870 and, the following year, a counter was opened at the Berlin Head Office for the sole purpose of transacting deposits business. One of the earliest private clients there was Otto Michaelis, Director of the German Imperial Chancellery. He opened a deposit account in 1876, which guaranteed fixed income rates and enabled payments made by cheque. By this time, private clients were also being advised on the purchase of bonds and shares, which they could keep in a securities account at the bank.

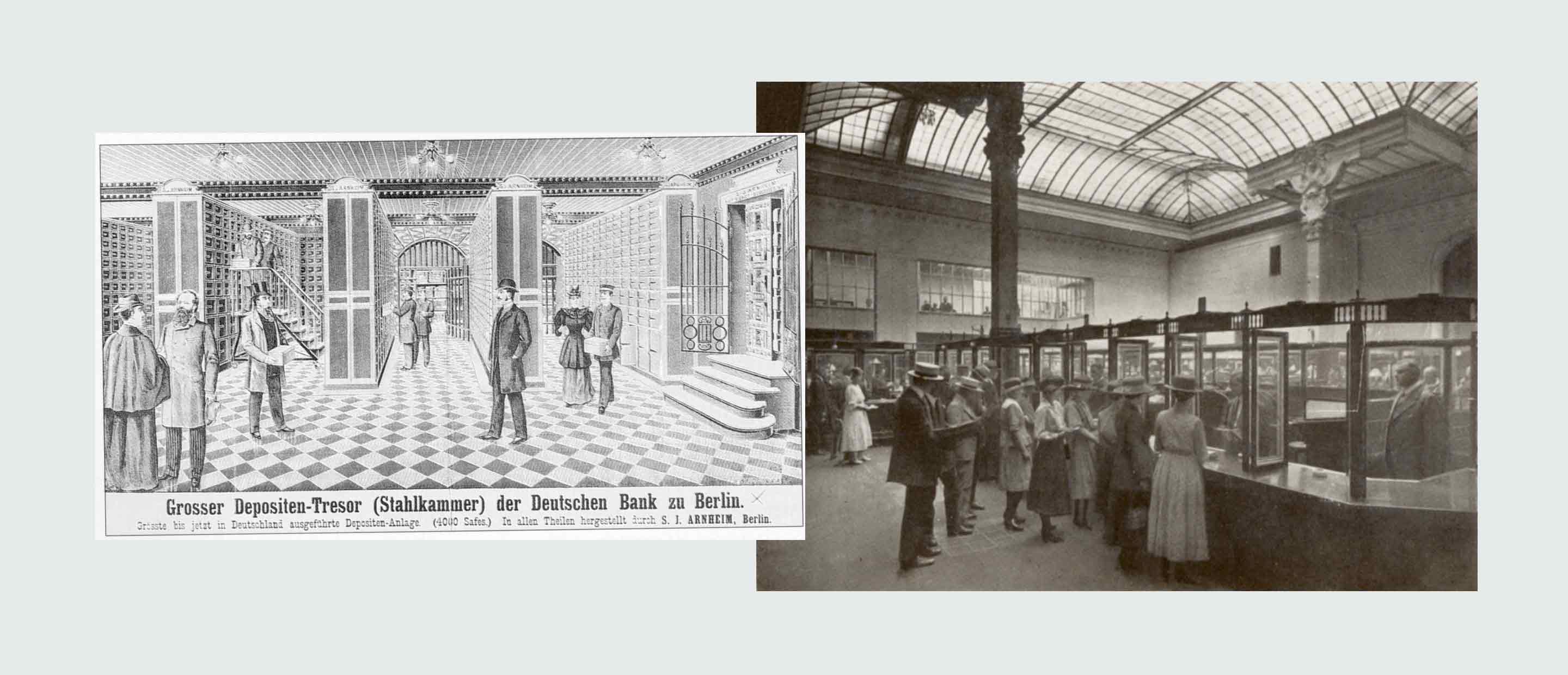

From 1891, Deutsche Bank offered its customers the use of safety deposit boxes in a strong-room, a service unknown until then. Wealthy customers who were travelling could store jewellery, silverware or other valuables there. It also created special private banking departments in larger branches, where clients could consult daily newspapers, financial journals and reference books in comfortable lounges.

It took until the late 1920s for Deutsche Bank to start offering savings accounts, which had previously been the domain of dedicated savings banks. And it was only after the dark years of the 1930s and 1940s that it finally used its experience of serving private clients to create innovative products and services that were accessible to all. Small loans and current accounts were introduced for retail clients in 1959/60. Then, from the 1980s onwards, it developed global operations in investment banking, corporate finance and asset management – as well as serving huge numbers of private customers in many countries.

Yet there would always be a significant number of wealthy families who required a more tailored service – whether because of multinational business interests, widespread assets and family members, cross-border lifestyles, complex family office and intermediary arrangements, unusual lending requirements, or all of these things and more. In late 2002, the bank established a wealth management division dedicated to their needs.

Deutsche Bank Wealth Management combined its experience serving entrepreneurs with the extensive capabilities of a global capital markets institution. In doing so, it was able to offer services and opportunities that would normally only be available to institutional investors, and to build a reputation for solving the most complex client problems.

How Deutsche Bank Wealth Management is returning to its roots while continuing to welcome complexity

When Claudio de Sanctis became Global Head of Deutsche Bank Wealth Management in 2019, he quickly reaffirmed its "unique focus on serving entrepreneurial individuals and families with European connectivity". This was a direct echo of the mission statement issued by the bank's founders 150 years before. The difference today is that Wealth Management is a truly global organisation, supporting entrepreneurs from over 80 countries.

"Nobody has an historical understanding for trade finance and the lending business like Deutsche Bank," de Sanctis told the Swiss business newspaper Finanz und Wirtschaft in June 2020. "We have been financing enterprises worldwide for 150 years. And I mean proper financing. We have been doing this with German, European, American and Asian companies who have been globally active for years and years, and this makes us almost unique."

After 150 years, Deutsche Bank is still ideally positioned to support entrepreneurial families. But it no longer matters where those families are located; all that counts is the scale of their ambition.

To find out more about the history of Deutsche Bank, please ask your relationship manager for a free copy of Deutsche Bank: The Global Hausbank (Bloomsbury, 2020), or visit db.com

With thanks to Dr Martin L. Müller, Head of Historical Institute, Deutsche Bank, for his help and support in creating this article.