Impact #2: Business reinvention – expect more change

• State support has risks • ESG – onwards and upwards • Tech still has a role to play • Earnings recovery is key

Individuals will start 2021 with hopes of return to the status quo ante – and companies will hope that the scaling down of coronavirus restrictions will lead to a quick recovery in global demand. But, like individuals, companies will not be able to go back to a pre-coronavirus world: they must continue to engage in a process of business reinvention.

Result #1: State support has risks

Extreme times need extreme policies – and the extension of state support to private sector businesses during the pandemic has gone largely unchallenged.

This support has been implicit (e.g. low borrowing costs, labour market support) if not explicit (e.g. equity stakes). But, however it is given, state support has risks.

One risk is that, in this era of rapid change, state support ultimately limits the ability of an economy to reinvent itself and ultimately thrive. Firms need to be allowed to prosper or fall back as the economic forest renews itself, as the 19th century English economist Alfred Marshall put it. The Austrian economist Joseph Schumpeter had a blunter turn of phrase: he referred to it as “creative destruction”.

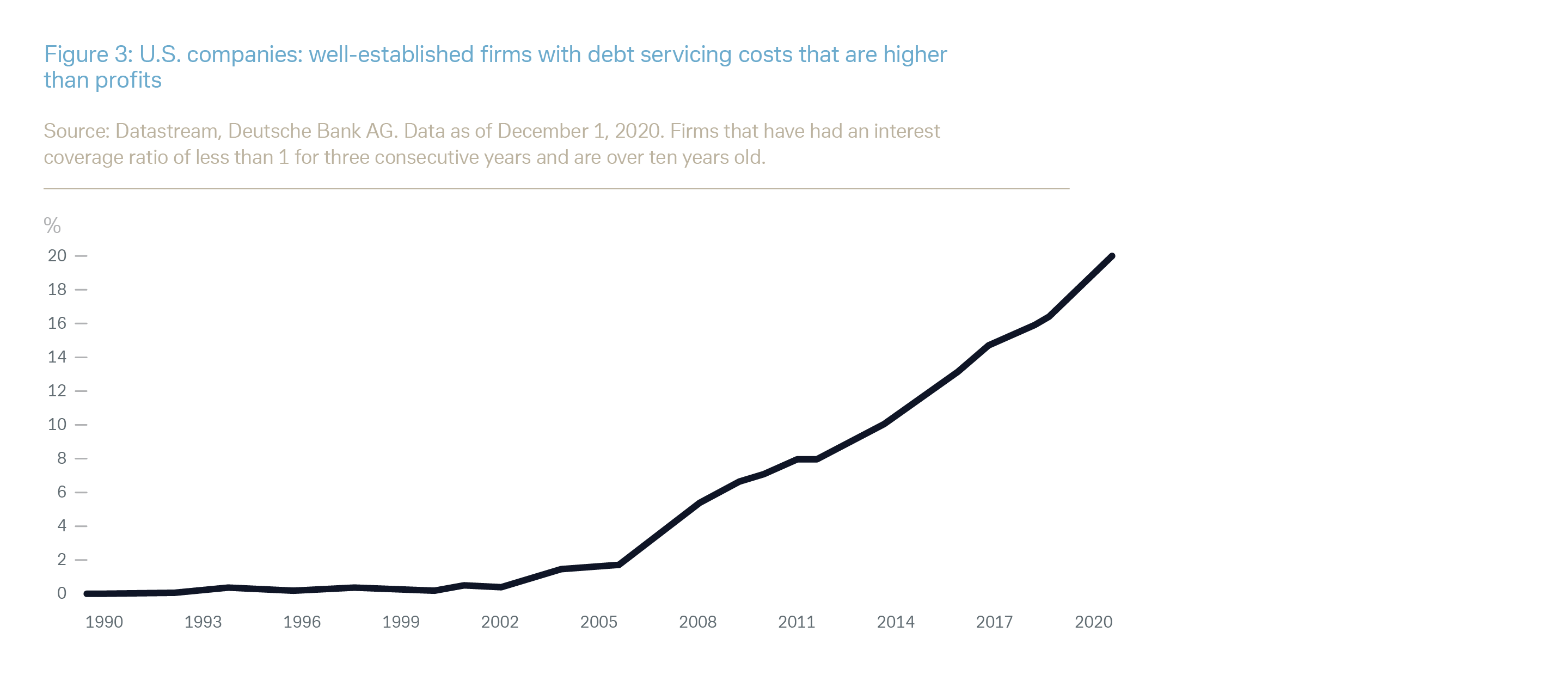

State support can hinder this process of renewal, although temporary support is welcome if a firm’s business model is clearly sustainable. Again, this is a problem that goes back way before the policy response to coronavirus but has been reinforced of late. Ever since the global financial crisis (2007 onwards) triggered radical monetary policy, very low interest rates have helped keep many companies afloat. But in many cases this may have encouraged them to take on debt to conceal underlying operational problems (as Figure 3 illustrates for the U.S.). The worry is that the economy will suffer through an increasing number of these no longer competitive firms, with the existence of government equity stakes in some firms or employment commitments potentially making economic restructuring more difficult. Regulatory commitments made as a result of state support may also complicate matters. Investing in firms that do not have a viable “post-COVID” operating model does not seem like a sensible long-term strategy and from a broader economic perspective hinders an efficient allocation of capital.

Result #2: ESG – onwards and upwards

The pandemic has demonstrated a continued commitment by many governments to environmental, social and governance (ESG) issues and continuing growth in investor interest. This defied initial concerns that a more brutal operating environment would result in the ditching of environmental and social and governance standards as firms desperately tried to reduce costs and survive. This has not happened, with continued strong inflows into ESG-managed assets throughout the year: Morningstar, for example, recently estimated that sustainable fund assets now accounted for 9.3% of total fund assets. We expect the share of ESG investments to continue to grow around the world.

Continued growth in interest in ESG investment can be ascribed to four factors.

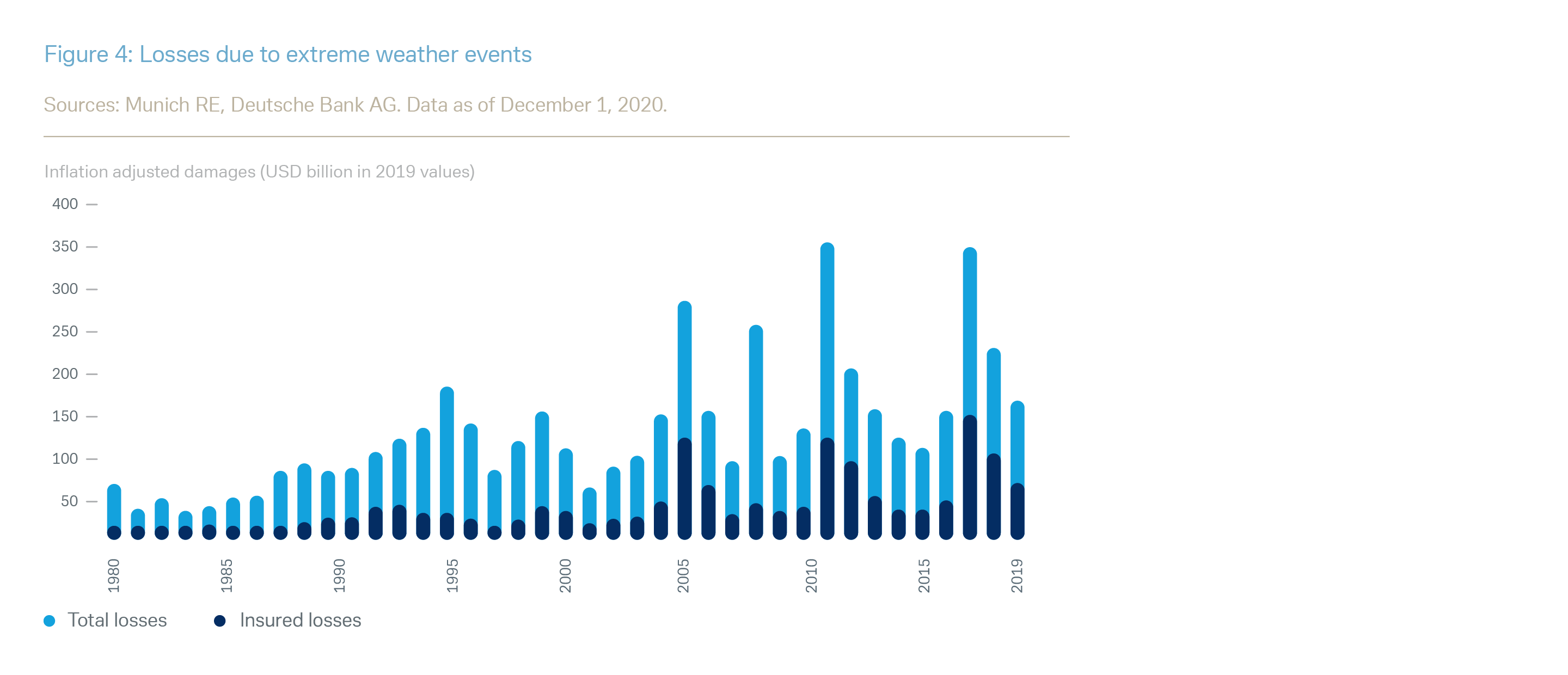

1. A growing realisation that an unstable operating and living environment may be partly due to failures in environmental management, which can and should be rectified. Growing interest in the dangers around climate change has broadened out into increasing concerns around declining biodiversity and the possible impact of this. An interesting way of translating concerns around extreme climate and other events is provided by Figure 4 which shows the rise in business losses as the result of such events over the past four decades.

2. Demographics means that younger investors’ interest in ESG is translating into higher levels of investment as well as political engagement. (One of our key investment themes is millennials.) Media coverage of, for example, the climate movement is a striking example of their political engagement. But younger demographics are also engaging economically, through their investment as well as consumption choices.

3. An increasing body of ESG legislation and compliance requirements exist not just in Europe but also around the world. By this, we do not mean simply the broad sustainable development goals and other commitments from the United Nations and other global regional bodies. Complementing this, more specific and granular regulation is now requiring firms not only to change their physical operational models (e.g. to reduce pollution), but also their financial models and commitments to meet ESG criteria.

4. Increasing evidence that ESG investment can boost long-term investment returns. More transparent and consistent ESG data and investment classifications will help clarify remaining issues here.

Underpinning this will be an environmental and social component to much of the talk about post- pandemic rebuilding – “build back better” is the phrase used in the U.S. and UK ESG, and some of its components, remains one of our key investment themes for 2021.

Result #3: Tech still has a role to play

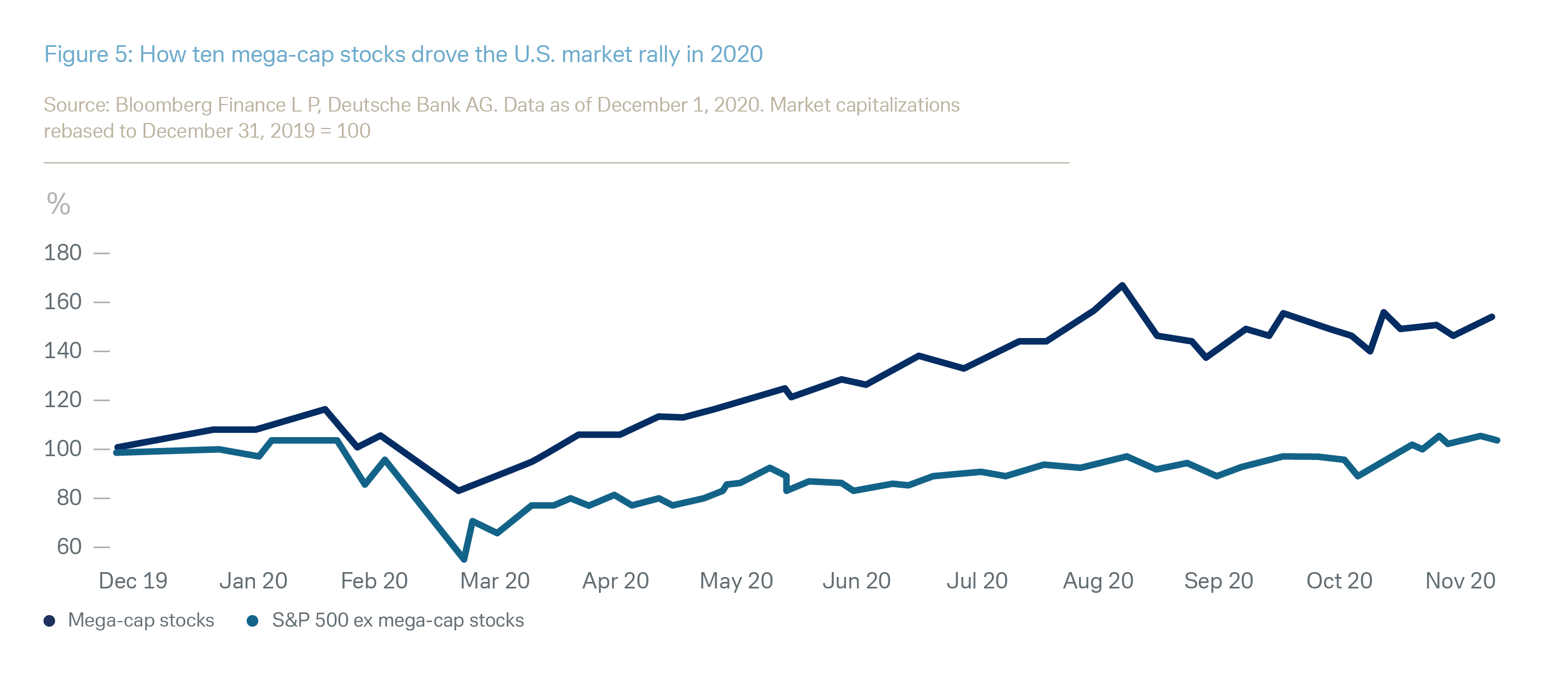

Business has been on the receiving end of changing consumer needs during 2020 with the pandemic initially producing some clear winners for most of the year (e.g. big tech, healthcare, online delivery services) and some losers. Big tech played a key role in holding up equity markets for much of 2020. Figure 5 compares the performance of S&P 500’s ten mega-cap stocks (usually tech-centred) and the index with these stocks excluded.

Towards the end of 2020, vaccine development news led to significant relative equity sector price moves as markets factored in hopes of a faster-than-expected economic reopening and recovery and these preferences are likely to change again during the course of 2021.

As sector preferences have been reassessed, one question has been whether tech will continue to play such a dominant role in equity market performance. Some arguments against tech (in an investment context) are founded on a belief that a return to more normal working conditions will reduce demand for tech services, but this seems unlikely – working conditions will not completely reverse, and tech is too deeply embedded in what we do. As we note in Impact #5, many of our key themes are tech-focused and include specific technology issues such as artificial intelligence and cyber security. At a market level, many tech stocks do also still offer the major benefits of apparently resilient earnings and strong balance sheets.

Result #4: Earnings recovery is key

Markets are likely to remain volatile in 2021 as the progress of vaccine rollouts (and the economic damage from coronavirus) continues to be reassessed. Switches in equity sector and style preferences will continue: trends may be fleeting and market optimism could turn to pessimism. (For example, at the time of writing we do not know the length of immunity to infection that the various new vaccines will give: if the immunity is only short-term, or vaccine implementation proves more difficult than expected, then markets may get more pessimistic again about market prospects.)

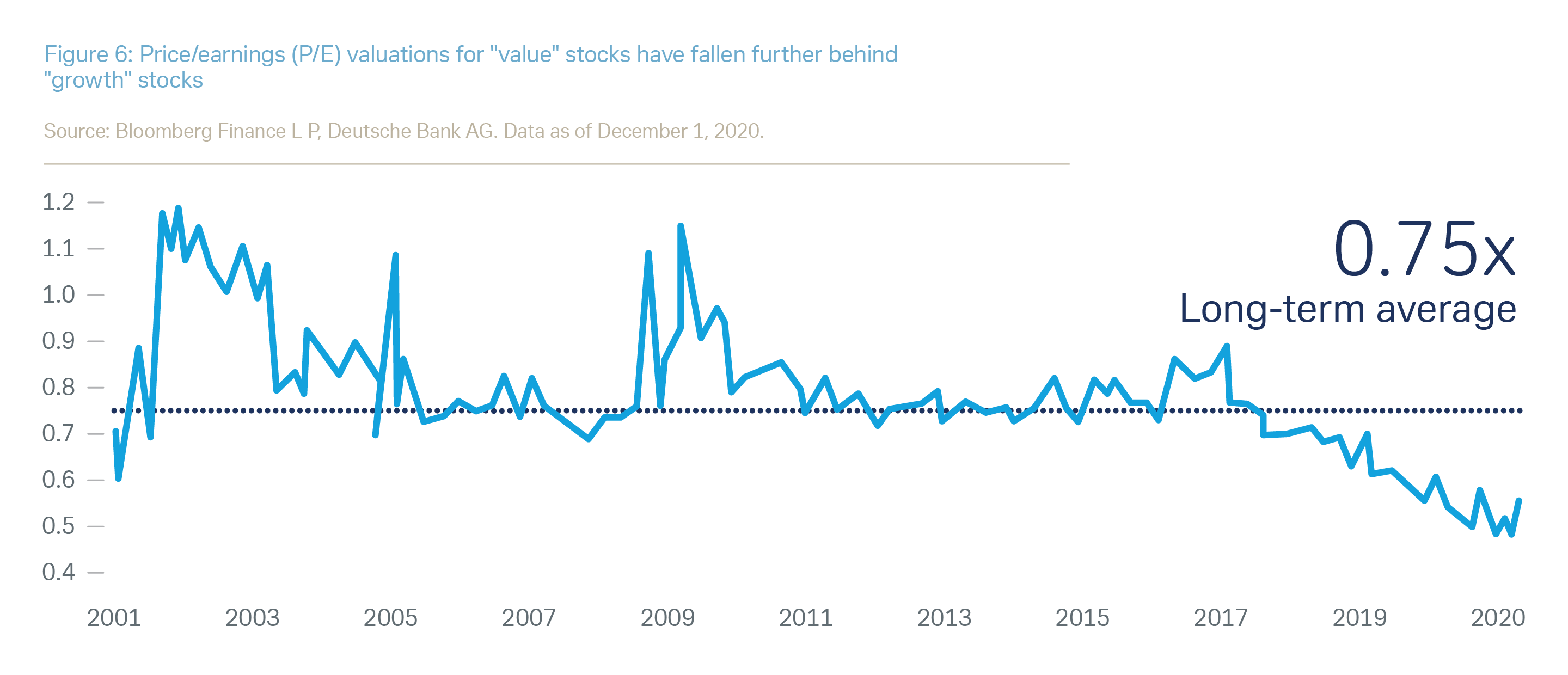

In short, we would suggest taking a balanced style here: "growth" [see footnote 1] stocks (strong performers for much of 2020 and previous years) are unlikely to be completely displaced by “cyclicals” or “value” stocks as the world economy gets back on its feet. Figure 6 illustrates the price/earnings discount of “value” to “growth” stocks – note that this has been widening for four years, not just during the pandemic. As was shown in late 2020, hopes around the reopening of the economy can benefit “cyclical” stocks, but an outright outperformance in “value” stocks will require higher yields, something that does not appear very likely in the years to come as a result of the crisis – although higher inflation cannot be ruled out.

Ultimately, however, market hopes of sectoral recovery will need to be backed up by a recovery in earnings. For the developed economies, this process could be rather a slog – in Europe, earnings may not be back to 2019 levels before 2023 – but in the interim European Small and Mid Caps may be an effective way to benefit from the reopening of the economy. For many emerging markets, particularly in Asia, stronger economic growth means that the process of earnings recovery could be rather faster, to the advantage of both firms and investors in them. This will add to the case for emerging market equities (and also emerging market corporate bonds). Stronger earnings growth remains essential to return valuations to more normal levels, and progress here will be evident during 2021.

Consequences

- State support limits an economy's ability to reinvent itself.

- ESG supported by stronger commitment and demand.

- Stock markets remain tech-centered, but cyclical has its appeal.

Our full CIO Insights report “Annual Outlook 2021: Tectonic shifts" includes our new macroeconomic and financial market forecasts for 2021. Please refer to the Important Notes at the end of the report for disclosures and risk warnings.

To download a printer-friendly PDF of the full report, please click here.

To view a mobile-optimised version of the full report, please click here.