Novo Holdings: pioneering life science investment

Novo Holdings Senior Partner Naveed Siddiqi discusses his company's role in advancing healthcare through strategic investments in life sciences, and shares his advice for those investing the sector

Novo Nordisk, the Danish pharmaceutical giant, has seen its public profile soar in recent years thanks to Ozempic, the anti-obesity drug. Yet its parent company arguably has the bigger story to tell.

Novo Holdings currently has about 149 billion euros of assets under management – including over 25 percent of the shares of Novo Nordisk – and is wholly owned by the Novo Nordisk Foundation, whose vision is "to improve people's health and the sustainability of society and the planet."

The profits from its investments fuelled around 9.1 Danish krone (1.3 billion euros) of philanthropic donations in 2024. It also invests around 2.9 billion euros annually in life science companies at all stages of development, with its Venture Investment team deploying around 673 million euros in 2024. So, there are few better places to find valuable insights for investors exploring the sector.

We were therefore honoured to welcome Dr Naveed Siddiqi to the Global Innovation Summit, to speak about his role as a Senior Partner for Venture Investments at Novo Holdings and to introduce us to two of his portfolio companies. Siddiqi has over 25 years of experience in life science venture investments and investment banking, having originally trained as a doctor at Guy’s and St Thomas’s Hospital Medical School in London.

What attendees learned from Novo Holdings at the Deutsche Bank Global Innovation Summit

Siddiqi began the session by explaining the origins of the Novo Nordisk Foundation, which has its roots in the 1920s, when Novo founders August and Marie Krogh acquired a licence to produce the diabetes drug insulin in Denmark and then sought to make it more widely available.

Today, Siddiqi explained, Novo Holdings is continuing their mission by investing in “high unmet medical needs”, seeking to improve public health and wellbeing by bringing similarly innovative treatments to market.

The session included presentations from representatives of two Novo Holdings portfolio companies:

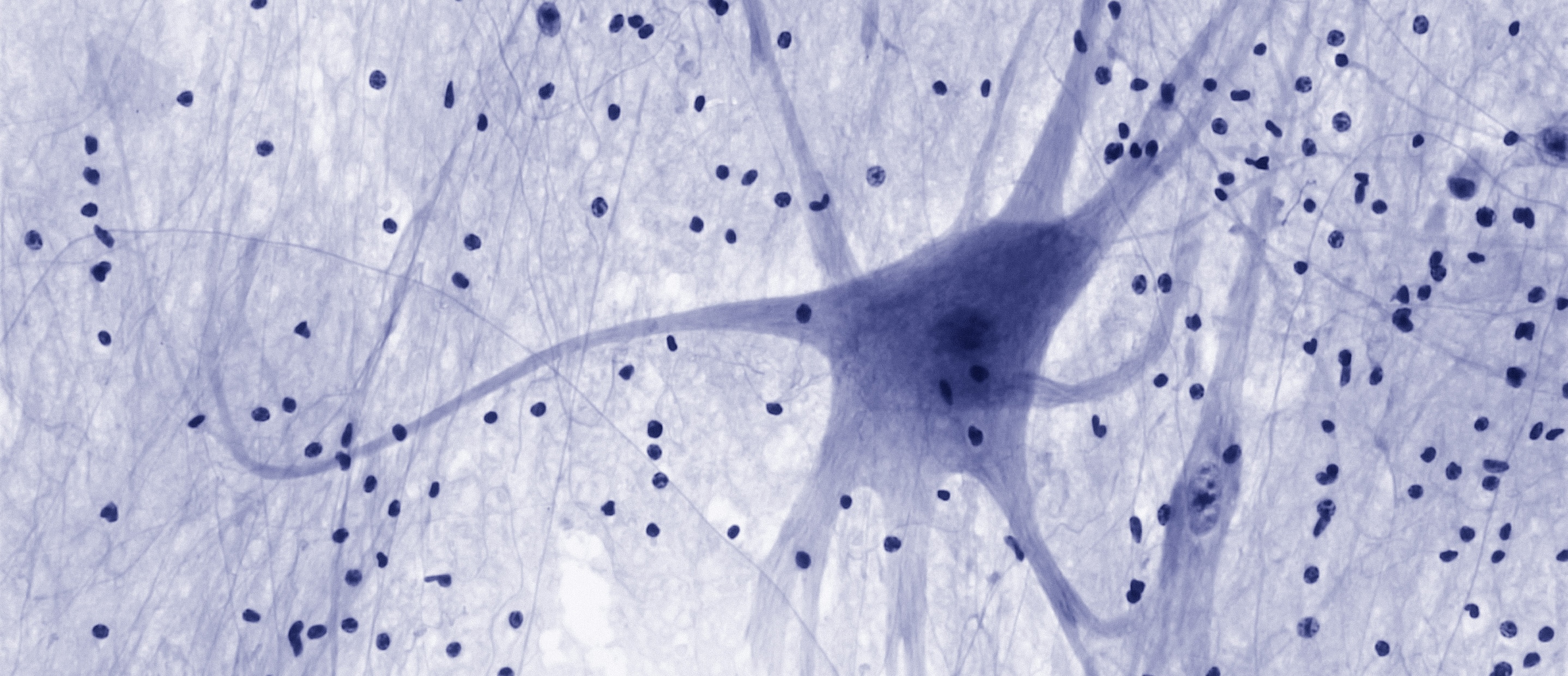

- Andrin Cerletti, Head of Business Development at Asceneuron, described his company’s work on Alzheimer's disease, focusing on a novel treatment that can be taken in tablet form to make it easier for patients to adhere to their treatment regimen.

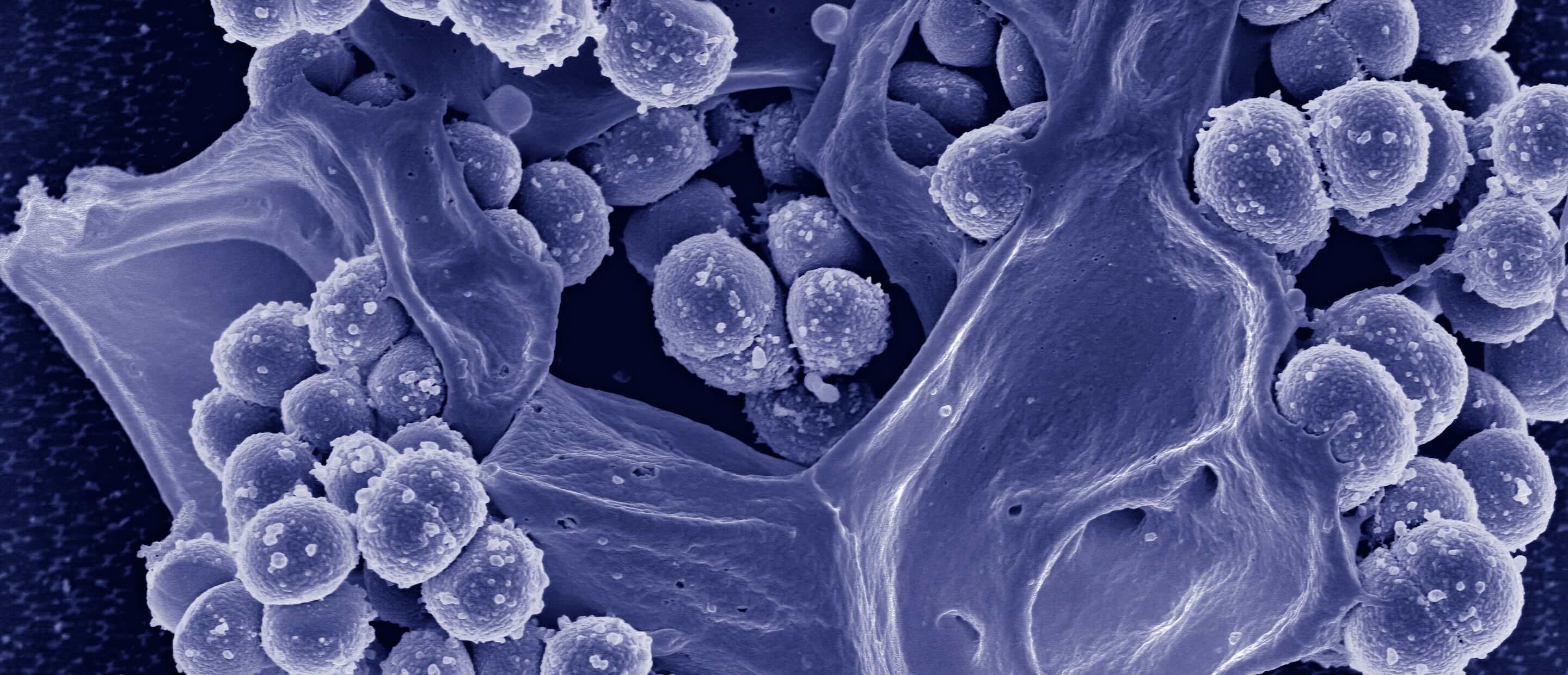

- Julie Mead, Chief Operating Officer at Myricx Bio, explained how her company is treating cancer with advanced “antibody-drug conjugates”, which combine the targeting ability of antibodies with the cancer-killing power of chemotherapy drugs.

The session concluded with a discussion on the role of AI in drug discovery, the importance of strong management teams in this sector, and the potential for family offices and philanthropists to participate in biotech investments. Siddiqi and his colleagues all underlined the need for long-term commitment and strategic collaboration to achieve significant advancements in healthcare.

Key takeaways from this session

- Invest in areas of high unmet needs: Siddiqi emphasised the importance of focusing on projects that address significant unmet medical needs. This approach not only advances patient care but also has the potential for substantial returns on investment.

- Collaboration is crucial: Novo Holdings collaborates with industry partners, other investors, and research institutions to advance medical research and bring new therapies to market. This collaborative approach helps share risks and resources, enhancing the chances of success.

- Look for radical innovation: Novo Holdings looks for projects that have the potential to bring groundbreaking treatments to market, rather than focusing on incremental improvements or generic drugs.

- Ensure strong management teams: Siddiqi highlighted the importance of having capable management teams who can execute projects effectively, and – critically – who can navigate the complexities of drug development and commercialisation.

- Leverage AI and technology: The use of AI and technology in drug discovery and development is becoming increasingly important. While AI is not a panacea, it can provide valuable insights and speed up the research process. However, it is essential to validate AI-generated results with actual experiments.

- Consider the entire lifecycle of investments: Novo Holdings Venture Investments team invests in early-stage programmes as well as companies transitioning to public status. This approach helps support companies throughout their development stages, from preclinical research to commercialisation.

- Be prepared for long-term commitments: Life sciences investments often require significant time and resources. Siddiqi and his colleagues stressed the importance of being patient and prepared for long-term commitments to see projects through to successful outcomes.

- Understand the regulatory landscape: Navigating the regulatory environment is a critical aspect of life sciences investments. Understanding the requirements and processes of regulatory bodies, such the U.S. Food and Drug Administration and the European Medicines Agency, is essential for bringing new therapies to market.